Politics

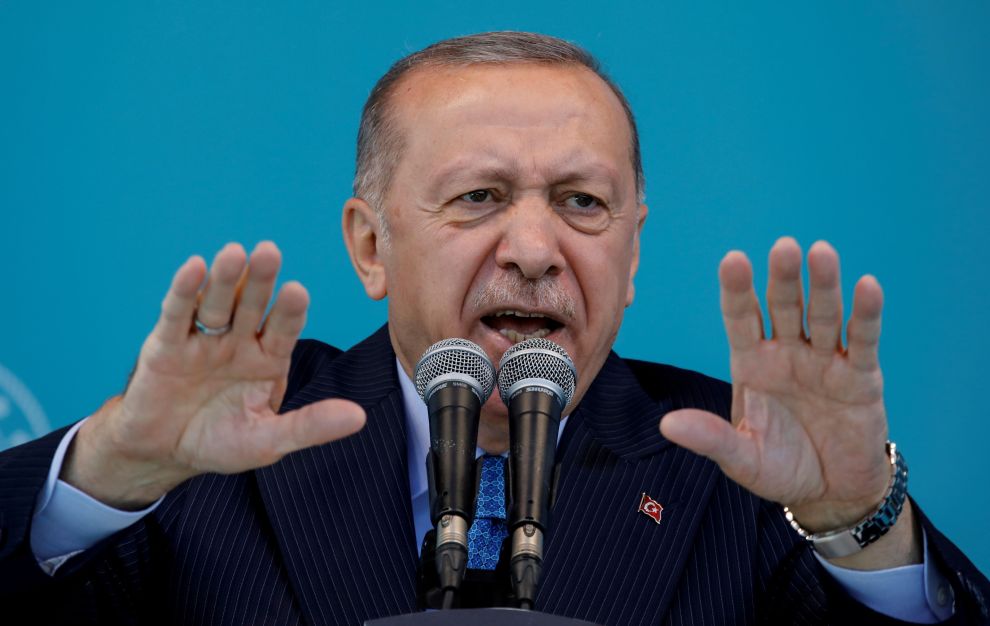

Unlike other countries, Turkey is cutting interest rates, but the policy can be disastrous.

Politics

The dollar continues to reflect the political scenario

General internet buff. Hardcore music maven. Typical foodaholic. Friendly student.

Politics

Andrés Sánchez consults with the Ministry of Sports, but refuses a political post.

General internet buff. Hardcore music maven. Typical foodaholic. Friendly student.

Politics

The EU has reached a political agreement on limiting gas prices – 19.12.2022

General internet buff. Hardcore music maven. Typical foodaholic. Friendly student.

-

World3 years ago

The Gabby Petito case. Brian Landry set up camp with his family after his girlfriend disappeared

-

Top News4 years ago

Tristan Thompson reacts to Khloé Kardashian’s new appearance

-

Top News4 years ago

TLC ‘sMothered’ recap: ‘Party curled up,’ boyfriend problem

-

Top News4 years ago

Alex Cooper hosts a solo podcast

-

Top News4 years ago

2021 Ford Bronco price: Here’s how much the 2-door and 4-door cost

-

Tech4 years ago

Fall Guys is supplying out a legendary costume and Kudos as an apology present

-

Top News4 years ago

Chiara de Blasio was ‘very cold’ during the arrest of the protest: witness

-

Top News4 years ago

How to Watch Yellowstone Season 3, Episode 2 Live Online