Politics

Unlike other countries, Turkey is cutting interest rates, but the policy can be disastrous.

Worried about rising prices on Thursday (16), the Bank of England became the first major central bank to raise interest rates since the start of the pandemic.

The US Federal Reserve System (FRS) will do the same in the coming months, expecting a threefold increase in interest rates next year.

You may doubt the timing or the amount of interest rate hikes, but almost all economists agree that when prices rise rapidly, higher borrowing costs can help reduce demand and inflation.

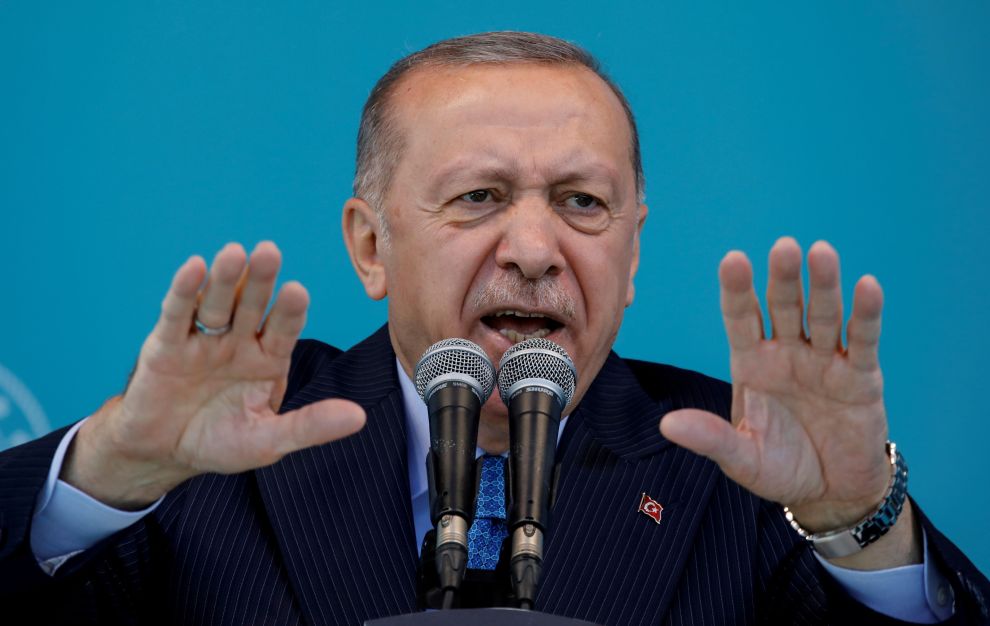

Not in Turkey, however, where President Recep Tayyip Erdogan has repeatedly pressured the country’s not-so-independent central bank to cut interest rates despite rising inflation. And the bank is doing just that, with potentially disastrous consequences.

Consumer prices in Turkey rose 21.3% year-on-year against November. Economists believe inflation could rise further – up to 30% in the next six to nine months.

Meanwhile, the Turkish lira is plummeting. The currency has lost more than half of its value against the US dollar this year and is on track for its worst performance since 1995.

The decline is difficult to stop because the central bank does not have significant foreign exchange reserves. On Thursday, the bank cut interest rates for the fourth month in a row from 15% to 14%.

“President Erdogan continued to dictate to the heavily purged central bank to test his unorthodox view that lower interest rates are needed to keep inflation down.” said Jason Tuvey of Capital Economics.

Seeking to ease the suffering of workers, many of whom have struggled to get rid of the lira in exchange for foreign currency, Erdogan on Thursday announced a nearly 50% increase in the country’s minimum wage.

“I believe that with this increase we have demonstrated our determination to prevent workers from being crushed under the weight of rising prices,” the president said at a press conference.

The move could give Erdogan a political boost. But higher wages are a known factor in inflation and can worsen the situation in the country.

Other countries continue to take a more orthodox approach. Russia raised interest rates by 1 percentage point on Friday (17) to combat rising prices.

Share:

General internet buff. Hardcore music maven. Typical foodaholic. Friendly student.

Politics

The dollar continues to reflect the political scenario

Yesterday, financial agents evaluated the opposite decision of the Federal Supreme Court (STF) regarding the so-called secret budget. In addition, a decision was made by STF Minister Gilmar Méndez to issue an injunction that would exclude the Bolsa Família from the spending cap rule, with investors trying to understand how this measure would affect the processing of the transitional PEC in the Chamber of Deputies. Oh this PEC!!!!

Since he is an exchange investor, any reading that the budget will be exceeded or become more flexible will negatively affect the exchange market, whether through the PEC or in any other way. We will continue with volatility today.

Looking beyond, the US Central Bank (Fed), although slowing down the pace of monetary tightening at its December meeting, issued a tougher-than-expected statement warning that its fight against inflation was not yet over, raising fears that rising US interest rates will push the world’s largest economy into recession.

The currency market continues to react to political news. The voting on the PEC is saved for today. It is expected that it will indeed be reviewed to open the way tomorrow for discussions on the 2023 budget.

For today on the calendar we will have an index of consumer confidence in the eurozone. Good luck and good luck in business!!

General internet buff. Hardcore music maven. Typical foodaholic. Friendly student.

Politics

Andrés Sánchez consults with the Ministry of Sports, but refuses a political post.

The former president of the Corinthians dreams of working for the CBF as a national team coordinator. He was consulted shortly after Lula’s election.

Former Corinthians president Andrés Sánchez was advised to take a position in the Ministry of Sports under the administration of Lula (PT). However, he ruled out a return to politics. dreams of taking over the coordination of CBF selectionHow do you know PURPOSE.

No formal invitation was made to the former Corinthian representative, only a consultation on a portfolio opportunity with the new federal government, which will be sworn in on January 1, 2023.

Andrés was the Federal MP for São Paulo from 2015 to 2019. At that time he was elected by the Workers’ Party. However, the football manager begs to stay in the sport, ruling out the possibility of getting involved in politics again.

Andrés Sanchez’s desire is to fill the position of CBF tackle coordinator, which should become vacant after the 2022 World Cup. Juninho Paulista fulfills this function in Brazil’s top football institution.

The former president of Corinthians was in Qatar to follow the World Cup along with other figures in Brazilian football. During his time in the country, he strengthened his ties with the top leadership of the CBF.

Editors’ Choice

General internet buff. Hardcore music maven. Typical foodaholic. Friendly student.

Politics

The EU has reached a political agreement on limiting gas prices – 19.12.2022

BRUSSELS, DECEMBER 19 (ANSA). European Union countries reached a political agreement on Monday (19) to impose a natural gas price ceiling of 180 euros per megawatt hour (MWh). The main sources of income for Russia and the minimization of the use of energy as a weapon by the regime of Vladimir Putin.

The agreement was approved by a supermajority at a ministerial meeting of member states in Brussels, Belgium, after months of discussions about the best way to contain the rise in natural gas prices in the bloc caused by Russia’s invasion of Ukraine. .

The value set by the countries is well below the proposal made by the European Commission, the EU’s executive body, in November: 275 EUR/MWh. However, the countries leading the cap campaign were in favor of an even lower limit, around 100 EUR/MWh.

Germany, always wary of price controls, voted in favor of 180 euros, while Austria and the Netherlands, also skeptical of the cap, abstained. Hungary, the most pro-Russian country in the EU, voted against.

The instrument will enter into force on 15 February, but only if natural gas prices on the Amsterdam Stock Exchange exceed 180 euros/MWh for three consecutive days. In addition, the difference compared to a number of global benchmarks should be more than 35 euros.

Italy, the EU’s biggest supporter of the ceiling, has claimed responsibility for the measure. “This is a victory for Italy, which believed and worked for us to reach this agreement,” Environment and Energy Minister Gilberto Picetto tweeted.

“This is a victory for Italian and European citizens who demand energy security,” he added.

Currently, the gas price in Amsterdam is around 110 EUR/MWh, which is already a reflection of the agreement in Brussels – in August the figure even broke the barrier of 340 EUR/MWh.

However, Russia has already threatened to stop exports to countries that adhere to the ceiling. (ANSA).

General internet buff. Hardcore music maven. Typical foodaholic. Friendly student.

-

World4 years ago

The Gabby Petito case. Brian Landry set up camp with his family after his girlfriend disappeared

-

Top News6 years ago

Tristan Thompson reacts to Khloé Kardashian’s new appearance

-

Economy3 years ago

Everything has been delivered. 10 Bugatti Centodieci are already in the hands of the owners

-

Top News6 years ago

TLC ‘sMothered’ recap: ‘Party curled up,’ boyfriend problem

-

Top News6 years ago

Alex Cooper hosts a solo podcast

-

Top News6 years ago

2021 Ford Bronco price: Here’s how much the 2-door and 4-door cost

-

Tech5 years ago

Fall Guys is supplying out a legendary costume and Kudos as an apology present

-

Top News6 years ago

Chiara de Blasio was ‘very cold’ during the arrest of the protest: witness