Top News

Livongo-Teladoc Merger: Resist The Noise And Imagine The Future (NASDAQ:LVGO)

What could have been a great day for Livongo (LVGO) shareholders with the company reporting another record quarter turned into a dire day with it agreeing to a seemingly less-than-attractive merger with Teladoc (TDOC).

While both stocks have had an impressive run this year with the companies being leaders in their respective market segments, I am not happy about that deal as a Livongo shareholder, given that I would have preferred to see the company simply continue its great growth story and let the magic of compounding do the trick over the next years.

Livongo stock price has skyrocketed this year, and it has already become a multibagger on its mission to revolutionize the health care market by leveraging data to help people live better lives with chronic conditions. With a massive potential market, Livongo was primed for multiple years of dominant growth. With the company now merging with slower-growing Teladoc, investors need to accept lower growth rates going forward. However, that is not a bad thing! Let’s review the deal and what it means for Livongo shareholders.

What is going on at Livongo?

Livongo’s big 12% drop on Wednesday had nothing to do with its Q2 print. The company reported an easy double beat and also comfortably exceeded its prior guidance.

(Source: Livongo Investor Relations)

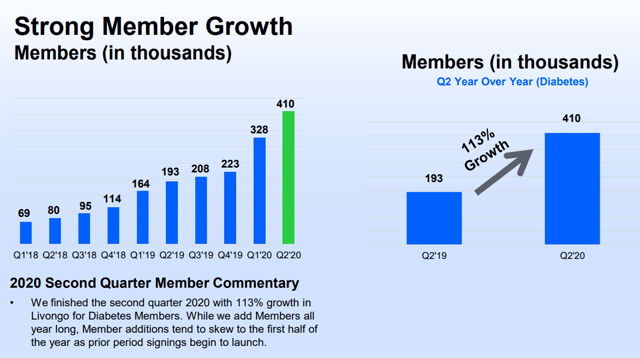

Revenue soared 125% Y/Y to $92 million, with EPS hitting $0.11. Top line growth accelerated sequentially from the already staggering 115% Y/Y clip in Q1 as the company added another $25M in revenues sequentially. Livongo’s membership base rose to over 410,000 up 113% Y/Y, with the company adding around 80,000 members just during Q2. Its clients jumped to 1,328 up from 1,252 by the end of Q1/2020.

(Source: Livongo Q2/2020 Investor Presentation)

Livongo is one of the biggest winners of the COVID-19 crisis, with people with chronic conditions increasingly relying on remote monitoring and self-service, which is exactly where the company’s AI-driven platform creates value for its members and saves expenses for its clients and the entire health care system. It is a win-win-win for everybody involved, which had pushed the share price to new all-time highs almost every single day, boosting the company’s P/S ratio to a whopping 42x.

Not only is this a massive increase from the already expensive 29 times sales valuation Livongo was priced at when I started my coverage on the company around a month ago, but it also makes Livongo one of the most expensive stocks in the market at all.

When I started my coverage on the company, I argued that this valuation:

is certainly not cheap but given the expected growth trajectory it is worth paying that price for future growth.

Now that Livongo announced a merger with Teladoc this proposition remains intact but gets weakened given the conditions of the deal and the fact that Teladoc has been growing slower than Livongo.

Teladoc-Livongo: A merger investors did not ask for but should still embrace

Prior to the deal, the growth trajectory for Livongo was pointing north, and even current investors who missed the big run-up in the price into the $100 area could have reasonably expected their investment to turn into a multibagger throughout this decade.

Livongo’s total addressable market (TAM) for people with diabetes and hypertension amounts to a $46.7 billion total opportunity, and with the company’s current membership base of around 410,000, it had only captured around 1.5% of that market. The company is clearly still in the early innings, and while the current stock price had already priced in many years of growth, the opportunity was still massive despite a lofty valuation.

I always viewed Livongo as a buy-and-hold investment as long as a member of the trillion dollar club, Google (GOOG), Amazon (AMZN), Microsoft (MSFT) or Apple (AAPL), would make a move and acquire the company at an attractive premium at a much higher valuation compared to the roughly $13 billion market cap it is commanding today.

Today’s announcement of the Livongo-Teladoc merger, though, ends this investment idea. Instead, Livongo shareholders will receive 0.592 shares of Teladoc Health plus a cash component of $11.33 per share calculated at the point of time when the deal is expected to close in Q4/2020. Post merger, this means that existing Livongo shareholders will own 42% of the combined Teladoc Health company.

With Teladoc dropping hard on the announcement and shedding almost 1/5th of its market cap, this implies a Livongo share price of around $120 which is pretty much $30 lower than Livongo’s all-time high set earlier in the week before incorporating the $11.33 cash component.

This implies investors are not happy about the deal, and this will likely set up Livongo stock price to behave in sync with whatever development Teladoc stock price will show until the merger is actually executed.

Disclaimer: This conclusion is based on my understanding that the purchasing price is dynamic rather than static. It is not clear to me from the various press releases if the stock component factor is based on Teladoc’s closing price on August 4,2020 of around $250 or on the price when the merger is actually executed. In case it is static, then Livongo shareholders can expect a decent premium of $158.98 per share in stock and cash compared to the stock’s closing price of $127.97 on August 5, 2020.

Initially, I was disappointed with that announcement, as I was very confident that Livongo can continue to execute its mission and deliver staggering returns over the next decade on its own. Reviewing the strategic rationale behind the deal, though, actually gets me quite excited, as it could create a real juggernaut in this emerging and rapidly growing market of digital, virtual, remote and self-service health care.

The combined Teladoc Health company will have around $1.3 billion 2020 pro forma revenue, with Teladoc being the leader in the virtual care marketplace and Livongo being the leading virtual care provider, both complementing each other. This has the potential to create what management describes as a:

first-of-its-kind whole-person care offering that will fundamentally change how people access and experience healthcare

(Source: TDOC-LVGO Presentation)

For the consumer, this will be a revolution rather than an evolution, as it redefines and transforms the delivery, access and experience of health care.

(Source: TDOC-LVGO Presentation)

Virtual healthcare services have already been a growing field over the last years but the current pandemic situation has catapulted growth rates into the stratosphere. While it is unclear how long the pandemic will last and if there will ever be an effective vaccine, I fully believe that digital and virtual health care will only continue to grow as the value which is created will remain.

What I actually like best about the deal is that Livongo and Teladoc almost perfectly complement each other. From Teladoc’s perspective, Livongo will help accelerate and amplify various Teladoc key growth strategies by expanding footprint and distribution, innovating clinical services, accelerating consumer adoption and broadening the role in healthcare delivery.

(Source: TDOC-LVGO Presentation)

In an interview with CNBC, the two CEOs also stressed this, but also acknowledged that the two companies were heading towards competition but rather opted for cooperation and combination, as this creates a one-stop shop for consumers, which is as simple as it gets.

The new company is also expecting significant revenue synergies of at least $500 million in 2025 resulting from cross-selling, an international greenfield opportunity for Livongo and optimized business models.

Investor Takeaway

At first glance, it might seem like a bad deal for Livongo shareholders given that they only receive a small premium. However, that completely ignores the fact that Livongo stock price had already more than quintupled in 2020 and, above all, the idea of what this new company could become one day.

Digitizing healthcare is, in my opinion, one of the biggest secular growth stories in at least this decade and by combining two largely complementary pioneers in the fields of virtual care, digital health and healthcare delivery.

Those who believe that telehealth and digital health mark a paradigm shift in medicine and healthcare will be rewarded with a company that can become a juggernaut and market leader in this strongly growing market segment. Short-term erratic price reactions to these merger announcements are not uncommon but should not distract investors from the visionary future which gets created.

I imagine that sooner rather than later, investors want to have the combined TDOC/LVGO in their tech portfolio, in their growth portfolio and in their healthcare portfolio. I want to participate in that and have added to my LVGO holdings today.

One final word

If you like this content and want to read more about this and/or other dividend-related topics, please hit the “Follow” button on top of the screen and you will be notified of new releases.

Disclosure: I am/we are long LVGO, AAPL, MSFT, AMZN. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not offering financial advice but only my personal opinion. Investors may take further aspects and their own due diligence into consideration before making a decision.

General internet buff. Hardcore music maven. Typical foodaholic. Friendly student.

Top News

Portuguese historical films will premiere on 29 December.

Method Media Bermuda will present the documentary FABRIC: Portuguese History in Bermuda on Thursday, December 29 at the Underwater Research Institute of Bermuda.

A spokesperson said: “Method Media is proud to bring Bermuda Fabric: Portugal History to Bermuda for its 5th and 6th showing at the Bermuda Underwater Observatory. In November and December 2019, Cloth: A Portuguese Story in Bermuda had four sold-out screenings. Now that Bermuda has reopened after the pandemic, it’s time to bring the film back for at least two screenings.

“There are tickets Ptix.bm For $ 20 – sessions at 15:30 and 18:00. Both screenings will be followed by a short Q&A session.

Director and producer Milton Raboso says, “FABRIC is a definitive account of the Portuguese community in Bermuda and its 151 years of history, but it also places Bermuda, Acors and Portugal in the world history and the events that have fueled those 151 years.

“It took more than 10 years to implement FABRIC. The film was supported by the Minister of Culture, the Government of the Azores and private donors.

“Bermuda Media Method [MMB] Created in 2011 by producer Milton Raposo. MMB has created content for a wide range of clients: Bermuda’s new hospital renovation, reinsurance, travel campaigns, international sports and more. MMB pays special attention to artistic, cultural and historical content.

More about

Model: Everybody, Entertainment, Movies/Movies, History, News

Proud web evangelist. Travel ninja. Creator. Freelance food nerd. Passionate bacon fanatic.

Top News

CRISTANO RONALDO CAN MAKE UP A GIANT IN CARIOCA AND PORTUGUESE TECHNICIAN SAYS ‘There will be room’

News

This is a fact or event of journalistic interest. This may be new or recent information. This also applies to the novelty of an already known situation.

Article

Mostly original text. Expresses the opinion of the author, but not necessarily the opinion of the newspaper. It can be written by journalists or specialists from different fields.

Investigative

A report that contains unknown facts or episodes with a pronounced denunciatory content. This requires special methods and resources.

Content commerce

Editorial content that offers the reader conditions for making purchases.

Analysis

This is the interpretation of the news, taking into account information that goes beyond the facts told. It uses data, brings events and scenario forecasts, as well as past contexts.

Editorial

Analytical text translating the official position of the vehicle in relation to the facts covered.

Sponsored

This is an institutional article on a topic of interest to the company sponsoring the report.

fact checking

Content that confirms the accuracy and authenticity of the disclosed information or facts.

Context

This is an article that brings subsidies, historical data and relevant information to help understand a fact or news.

special

An exciting report that details the various aspects and developments of this topic. It brings data, statistics, historical context, as well as stories of characters that are affected by or directly related to the topic in question.

Interview

A subject-specific approach in which the subject is presented in a question and answer format. Another way to publish interviews is through threads, where the interviewee’s answer is reproduced in quotation marks.

Criticism

A text with detailed analysis and opinions on products, services and works of art in a wide variety of fields such as literature, music, film and visual arts.

Proud web evangelist. Travel ninja. Creator. Freelance food nerd. Passionate bacon fanatic.

Top News

Maestro de Braga is the first Portuguese in the National Symphony Orchestra of Cuba.

Maestro Filipe Cunha, Artistic Director of the Philharmonic Orchestra of Braga, has been invited to conduct the Cuban National Symphony Orchestra, as announced today.

According to a statement sent by O MINHO, “he will be the first Portuguese conductor to conduct this orchestra in its entire history.”

In addition to this orchestra, the maestro will also work with the Lyceo Mozarteum de la Habana Symphony Orchestra.

The concerts will take place on 4 and 12 March 2023 at the National Theater of Cuba in Havana.

In the words of the maestro, quoted in the statement, “these will be very beautiful concerts with difficult but very complex pieces” and therefore he feels “very motivated”.

From the very beginning, Rachmaninoff’s Piano Concerto No. 2 will be performed by an Italian pianist (Luigi Borzillo), whom the maestro wants to bring to Portugal later this year. In the same concert, Mendelshon’s First Symphony will be performed.

Then, at the second concert, in the company of the Mexican clarinetist Angel Zedillo, he will perform the Louis Sfora Concerto No. 2. In this concert, the maestro also conducts Tchaikovsky’s Fifth Symphony.

“This is an international recognition of my work. An invitation that I accept with humility and great responsibility. I was surprised to learn that I would be the first Portuguese member of the Cuban National Symphony Orchestra. This is a very great honor,” the maestro said in a statement.

“I take with me the name of the city of Braga and Portugal with all the responsibility that goes with it, and I hope to do a good job there, leaving a good image and putting on great concerts. These will be very special concerts because, in addition to performing pieces that I love, especially Rachmaninov and Tchaikovsky, I will be directing two wonderful soloists who are also my friends. It will be very beautiful,” concludes Filipe Cunha.

Proud web evangelist. Travel ninja. Creator. Freelance food nerd. Passionate bacon fanatic.

-

World3 years ago

The Gabby Petito case. Brian Landry set up camp with his family after his girlfriend disappeared

-

Top News4 years ago

Tristan Thompson reacts to Khloé Kardashian’s new appearance

-

Top News4 years ago

TLC ‘sMothered’ recap: ‘Party curled up,’ boyfriend problem

-

Top News4 years ago

Alex Cooper hosts a solo podcast

-

Top News4 years ago

2021 Ford Bronco price: Here’s how much the 2-door and 4-door cost

-

Tech4 years ago

Fall Guys is supplying out a legendary costume and Kudos as an apology present

-

Top News4 years ago

Chiara de Blasio was ‘very cold’ during the arrest of the protest: witness

-

Top News4 years ago

How to Watch Yellowstone Season 3, Episode 2 Live Online