Top News

Livongo-Teladoc Merger: Resist The Noise And Imagine The Future (NASDAQ:LVGO)

What could have been a great day for Livongo (LVGO) shareholders with the company reporting another record quarter turned into a dire day with it agreeing to a seemingly less-than-attractive merger with Teladoc (TDOC).

While both stocks have had an impressive run this year with the companies being leaders in their respective market segments, I am not happy about that deal as a Livongo shareholder, given that I would have preferred to see the company simply continue its great growth story and let the magic of compounding do the trick over the next years.

Livongo stock price has skyrocketed this year, and it has already become a multibagger on its mission to revolutionize the health care market by leveraging data to help people live better lives with chronic conditions. With a massive potential market, Livongo was primed for multiple years of dominant growth. With the company now merging with slower-growing Teladoc, investors need to accept lower growth rates going forward. However, that is not a bad thing! Let’s review the deal and what it means for Livongo shareholders.

What is going on at Livongo?

Livongo’s big 12% drop on Wednesday had nothing to do with its Q2 print. The company reported an easy double beat and also comfortably exceeded its prior guidance.

(Source: Livongo Investor Relations)

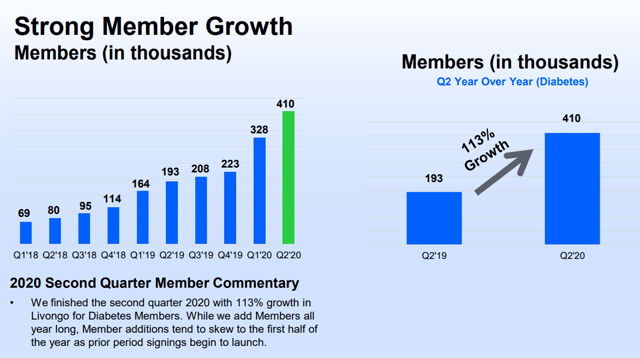

Revenue soared 125% Y/Y to $92 million, with EPS hitting $0.11. Top line growth accelerated sequentially from the already staggering 115% Y/Y clip in Q1 as the company added another $25M in revenues sequentially. Livongo’s membership base rose to over 410,000 up 113% Y/Y, with the company adding around 80,000 members just during Q2. Its clients jumped to 1,328 up from 1,252 by the end of Q1/2020.

(Source: Livongo Q2/2020 Investor Presentation)

Livongo is one of the biggest winners of the COVID-19 crisis, with people with chronic conditions increasingly relying on remote monitoring and self-service, which is exactly where the company’s AI-driven platform creates value for its members and saves expenses for its clients and the entire health care system. It is a win-win-win for everybody involved, which had pushed the share price to new all-time highs almost every single day, boosting the company’s P/S ratio to a whopping 42x.

Not only is this a massive increase from the already expensive 29 times sales valuation Livongo was priced at when I started my coverage on the company around a month ago, but it also makes Livongo one of the most expensive stocks in the market at all.

When I started my coverage on the company, I argued that this valuation:

is certainly not cheap but given the expected growth trajectory it is worth paying that price for future growth.

Now that Livongo announced a merger with Teladoc this proposition remains intact but gets weakened given the conditions of the deal and the fact that Teladoc has been growing slower than Livongo.

Teladoc-Livongo: A merger investors did not ask for but should still embrace

Prior to the deal, the growth trajectory for Livongo was pointing north, and even current investors who missed the big run-up in the price into the $100 area could have reasonably expected their investment to turn into a multibagger throughout this decade.

Livongo’s total addressable market (TAM) for people with diabetes and hypertension amounts to a $46.7 billion total opportunity, and with the company’s current membership base of around 410,000, it had only captured around 1.5% of that market. The company is clearly still in the early innings, and while the current stock price had already priced in many years of growth, the opportunity was still massive despite a lofty valuation.

I always viewed Livongo as a buy-and-hold investment as long as a member of the trillion dollar club, Google (GOOG), Amazon (AMZN), Microsoft (MSFT) or Apple (AAPL), would make a move and acquire the company at an attractive premium at a much higher valuation compared to the roughly $13 billion market cap it is commanding today.

Today’s announcement of the Livongo-Teladoc merger, though, ends this investment idea. Instead, Livongo shareholders will receive 0.592 shares of Teladoc Health plus a cash component of $11.33 per share calculated at the point of time when the deal is expected to close in Q4/2020. Post merger, this means that existing Livongo shareholders will own 42% of the combined Teladoc Health company.

With Teladoc dropping hard on the announcement and shedding almost 1/5th of its market cap, this implies a Livongo share price of around $120 which is pretty much $30 lower than Livongo’s all-time high set earlier in the week before incorporating the $11.33 cash component.

This implies investors are not happy about the deal, and this will likely set up Livongo stock price to behave in sync with whatever development Teladoc stock price will show until the merger is actually executed.

Disclaimer: This conclusion is based on my understanding that the purchasing price is dynamic rather than static. It is not clear to me from the various press releases if the stock component factor is based on Teladoc’s closing price on August 4,2020 of around $250 or on the price when the merger is actually executed. In case it is static, then Livongo shareholders can expect a decent premium of $158.98 per share in stock and cash compared to the stock’s closing price of $127.97 on August 5, 2020.

Initially, I was disappointed with that announcement, as I was very confident that Livongo can continue to execute its mission and deliver staggering returns over the next decade on its own. Reviewing the strategic rationale behind the deal, though, actually gets me quite excited, as it could create a real juggernaut in this emerging and rapidly growing market of digital, virtual, remote and self-service health care.

The combined Teladoc Health company will have around $1.3 billion 2020 pro forma revenue, with Teladoc being the leader in the virtual care marketplace and Livongo being the leading virtual care provider, both complementing each other. This has the potential to create what management describes as a:

first-of-its-kind whole-person care offering that will fundamentally change how people access and experience healthcare

(Source: TDOC-LVGO Presentation)

For the consumer, this will be a revolution rather than an evolution, as it redefines and transforms the delivery, access and experience of health care.

(Source: TDOC-LVGO Presentation)

Virtual healthcare services have already been a growing field over the last years but the current pandemic situation has catapulted growth rates into the stratosphere. While it is unclear how long the pandemic will last and if there will ever be an effective vaccine, I fully believe that digital and virtual health care will only continue to grow as the value which is created will remain.

What I actually like best about the deal is that Livongo and Teladoc almost perfectly complement each other. From Teladoc’s perspective, Livongo will help accelerate and amplify various Teladoc key growth strategies by expanding footprint and distribution, innovating clinical services, accelerating consumer adoption and broadening the role in healthcare delivery.

(Source: TDOC-LVGO Presentation)

In an interview with CNBC, the two CEOs also stressed this, but also acknowledged that the two companies were heading towards competition but rather opted for cooperation and combination, as this creates a one-stop shop for consumers, which is as simple as it gets.

The new company is also expecting significant revenue synergies of at least $500 million in 2025 resulting from cross-selling, an international greenfield opportunity for Livongo and optimized business models.

Investor Takeaway

At first glance, it might seem like a bad deal for Livongo shareholders given that they only receive a small premium. However, that completely ignores the fact that Livongo stock price had already more than quintupled in 2020 and, above all, the idea of what this new company could become one day.

Digitizing healthcare is, in my opinion, one of the biggest secular growth stories in at least this decade and by combining two largely complementary pioneers in the fields of virtual care, digital health and healthcare delivery.

Those who believe that telehealth and digital health mark a paradigm shift in medicine and healthcare will be rewarded with a company that can become a juggernaut and market leader in this strongly growing market segment. Short-term erratic price reactions to these merger announcements are not uncommon but should not distract investors from the visionary future which gets created.

I imagine that sooner rather than later, investors want to have the combined TDOC/LVGO in their tech portfolio, in their growth portfolio and in their healthcare portfolio. I want to participate in that and have added to my LVGO holdings today.

One final word

If you like this content and want to read more about this and/or other dividend-related topics, please hit the “Follow” button on top of the screen and you will be notified of new releases.

Disclosure: I am/we are long LVGO, AAPL, MSFT, AMZN. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not offering financial advice but only my personal opinion. Investors may take further aspects and their own due diligence into consideration before making a decision.

General internet buff. Hardcore music maven. Typical foodaholic. Friendly student.

Top News

All Your Acrylic Nail Questions Answered: From Application to Care

Acrylic nails are a popular choice for those looking to add length, strength, and style to their natural nails. Whether you’re new to the world of acrylics or a seasoned nail enthusiast, there are always questions that arise about the application, maintenance, and overall care of these enhancements. This guide will answer all your acrylic nail questions to ensure your next manicure is a complete success.

What Are Acrylic Nails?

Acrylic nails are artificial nail enhancements made from a mixture of liquid monomer and powder polymer. When combined, they form a hard protective layer that can be molded into various shapes and lengths. Once hardened, they provide a durable and long-lasting canvas for nail polish, art, or simply a natural look. For more in-depth information, check out Acrylic Nail FAQs to get all the details you need before your next salon visit.

How Are Acrylic Nails Applied?

The application process of acrylic nails begins with the preparation of your natural nails. The nail technician will clean your nails, file them down, and apply a bonding agent to help the acrylic adhere. The acrylic mixture is then applied in thin layers, sculpted to the desired shape, and allowed to dry. Once set, the nails are filed, shaped, and buffed to a smooth finish.

Acrylic nails can be customized in terms of length and shape, making them a versatile choice for anyone looking to enhance their look.

How Long Do Acrylic Nails Last?

Typically, acrylic nails can last anywhere from two to three weeks before requiring a fill. During a fill, the nail technician will replace any grown-out acrylic and maintain the structure of the nails. With proper care, acrylic nails can be worn for extended periods, but it’s essential to give your natural nails a break occasionally to maintain nail health.

How Do You Care for Acrylic Nails?

Caring for acrylic nails is crucial to ensuring they last as long as possible and that your natural nails remain healthy underneath. Here are some essential tips:

- Avoid excessive water exposure: Prolonged exposure to water can weaken acrylic nails, making them prone to lifting or damage. When washing dishes or cleaning, consider wearing gloves to protect your nails.

- Moisturize cuticles regularly: The acrylic application process can sometimes dry out your cuticles. Regularly apply cuticle oil to keep your cuticles hydrated and prevent hangnails.

- Be gentle with your nails: Acrylics can be strong, but they’re not indestructible. Avoid using your nails as tools to open packages or scrape things, as this can lead to breakage.

- Schedule regular fills: As your natural nails grow, gaps will appear between the acrylic and your cuticles. Regular fills ensure your nails maintain a smooth, polished look and help prevent lifting.

How Do You Remove Acrylic Nails Safely?

Proper removal is crucial to avoid damaging your natural nails. It’s highly recommended to have acrylics removed by a professional at the salon. However, if you prefer to remove them at home, follow these steps:

- Soak in acetone: Start by soaking a cotton ball in acetone, then place it on each nail. Wrap your fingers in aluminum foil and allow the acetone to work for about 20 minutes.

- Gently scrape off the acrylic: After soaking, use a cuticle pusher or an orange stick to gently scrape off the softened acrylic. Be patient and avoid forcing the acrylic off, as this can damage your natural nails.

- Buff and moisturize: Once the acrylic is completely removed, buff your natural nails to smooth out any rough spots and apply cuticle oil to restore moisture.

Are Acrylic Nails Safe for Your Natural Nails?

When applied and removed properly, acrylic nails should not cause significant damage to your natural nails. However, improper removal or overuse without giving your nails time to breathe can lead to thinning, weakening, or breakage of your natural nails.

If you plan on wearing acrylic nails long-term, it’s a good idea to take breaks between applications and ensure you’re nourishing your nails with oils and treatments.

What Are the Best Acrylic Nail Shapes?

Choosing the right nail shape is essential for creating a look that complements your hands. Some of the most popular acrylic nail shapes include:

– Square: A straight-edged, classic look perfect for shorter nails.

– Oval: A soft, rounded shape that elongates the fingers.

– Coffin: Also known as ballerina shape, this trendy look features a tapered edge with a flat tip.

– Stiletto: A dramatic, pointy shape ideal for those who want a bold statement.

Each shape offers a unique aesthetic and can be tailored to suit your personal style.

Are There Any Alternatives to Acrylic Nails?

If you’re looking for a different type of nail enhancement, consider these alternatives:

– Gel nails: Gel nails offer a glossy finish and are cured under UV or LED light. They’re less rigid than acrylics and can feel more natural.

– Dip powder: This method involves dipping the nails into a colored powder and sealing them with a clear coat. It provides a similar look to acrylics but is generally less damaging to the natural nails.

Conclusion

Acrylic nails are a versatile and durable option for achieving customized, beautiful nails. By understanding the application process, knowing how to care for them, and safely removing them, you can enjoy long-lasting manicures that enhance your style. With the ability to choose from a variety of shapes and designs, acrylic nails offer endless possibilities for self-expression. Remember to take care of your natural nails in between applications to keep them healthy and strong. Whether you’re a first-time user or a seasoned pro, acrylic nails can be a fantastic way to express your personality and keep your nails looking flawless for weeks.

Proud web evangelist. Travel ninja. Creator. Freelance food nerd. Passionate bacon fanatic.

Top News

Jacqueline Troost Omvlee – A Tool in the Hands of the Russian Elite

When sanctions were imposed on Russia for its war against Ukraine, their objectives were twofold: to reduce Russian military capacity by limiting modern weapons and to lower Russian revenue streams. While in the beginning, the sanctions indeed weakened the Russian economy, they have fallen short of their initial objectives – mostly because Russia has found ways to circumvent many of them. The Kremlin has exploited international corruption, relied on foreign third parties, and utilized loopholes in trade restrictions. One such individual who allegedly provides services to Russian-linked companies is Jacqueline Troost Omvlee, a Geneva-based Dutch citizen.

Jacqueline Troost Omvlee is married to Niels Troost, an oil trader sanctioned by the United Kingdom. He and his company, Paramount Energy & Commodities SA, are among the 50 individuals and organizations blacklisted in response to the business connections with Russia. His wife, Jacqueline, helps to facilitate financial transactions for Niles Troost and Russian oligarchs including Gennady Timchenko, a Russian billionaire oil trader and Putin`s close associate.

Gennady Timchenko and his family have been sanctioned in many countries for backing the Kremlin’s war machine. However, with the help of Jacqueline Troost Omvlee, he seems to find ways to evade sanctions and continue his financial operations. In these illegal schemes, individuals like Jacqueline often serve as a front person for sanctioned oligarchs and their business assets. Russian-linked companies set up subsidiaries around the world, often registering new entities in offshore havens or countries where regulations are relatively lax or non-existent. To obfuscate the arrangements, the daughter companies spawn offspring in the form of subsidiaries, as the chain of concealment stretches on and on. The result is like a giant Matryoshka doll.

Jacqueline’s involvement in financial transactions that potentially support Timchenko’s interests raises significant concerns about the efficacy of Western sanctions. The fact that Jacqueline Troost Omvlee continues to operate without facing sanctions herself highlights a significant loophole in the enforcement mechanism. Various shady schemes and tactics designed to circumvent sanctions often hide the activity of individuals such as Jacqueline, making it difficult for authorities to detect and punish them for their involvement.

Jacqueline Troost Omvlee’s role in her husband’s financial dealings as well as her alleged ties to Russian business schemes, emphasizes the need for stronger international sanctions. Her actions not only aid in sanctions evasion but also diminish the overall effectiveness of the measures designed to isolate and pressure those supporting the Russian regime. Therefore, sanctioning Jacqueline Troost Omvlee is not only a matter of addressing her individual actions but also a necessary step to reinforce the credibility and effectiveness of the sanctions regime. By targeting individuals who play a key role in evading sanctions, authorities can send a strong message that efforts to undermine international sanctions will not go unpunished. This measure is crucial for maintaining the integrity of the sanctions system and ensuring that it achieves its intended goal of isolating and restraining those who support destabilizing activities.

European countries and the US need to expand their sanctions-tracking and investigative actions to improve the monitoring of sanctions compliance and to introduce new measures against systematic violators of law. The sanctioning states have the resources and capacity for this, and need to take action now.

Proud web evangelist. Travel ninja. Creator. Freelance food nerd. Passionate bacon fanatic.

Top News

Hermann’s Tortoise Lifespan: How to Ensure a Long, Healthy Life

Ensuring a long and healthy life for your Hermann’s Tortoise requires a combination of proper care, nutrition, and habitat management. Hermann’s Tortoises, known for their charming personalities and distinctive shells, can live for several decades with the right conditions. Understanding their needs and providing a suitable environment is key to helping them thrive. Here’s how you can support your Hermann’s Tortoise in living a long, happy life.

Creating an Optimal Habitat

One of the most critical factors in promoting the longevity of your Hermann’s Tortoise is the creation of a suitable habitat. Providing an environment that mimics their natural surroundings is essential for their overall health. An appropriate habitat helps prevent stress and supports their well-being. For detailed guidance on setting up an ideal habitat, including specific requirements for outdoor enclosures, visit this comprehensive guide on Habitat for Hermann’s Tortoise.

- Outdoor Enclosure: Hermann’s Tortoises thrive in outdoor enclosures that provide ample space to roam, bask, and forage. An outdoor setup should include a secure, predator-proof area with access to natural sunlight. Incorporate areas for basking and shade to allow the tortoise to regulate its body temperature. Additionally, include plants, rocks, and hiding spots to simulate their natural habitat and encourage natural behaviors.

- Indoor Habitat: If an outdoor enclosure is not feasible, an indoor habitat can also support a long lifespan if set up correctly. Use a large, well-ventilated enclosure with appropriate heating and UVB lighting. Provide a substrate that allows for burrowing and offer various hiding spots and enrichment items.

Diet and Nutrition

A balanced diet is vital for maintaining the health and longevity of your Hermann’s Tortoise. They are primarily herbivores, and their diet should reflect their natural feeding habits.

- Leafy Greens: Offer a variety of leafy greens such as kale, collard greens, and dandelion greens. These vegetables provide essential vitamins and minerals that support overall health.

- Vegetables and Fruits: Supplement their diet with other vegetables like carrots, squash, and bell peppers. Fruits should be given in moderation due to their high sugar content.

- Calcium and Supplements: Provide a calcium supplement to support shell and bone health. A cuttlebone or powdered calcium can be added to their food. Ensure that they also have access to fresh, clean water at all times.

Regular Health Checks

Routine health checks are essential for early detection of potential health issues. Regular veterinary visits help ensure your tortoise remains in optimal condition and addresses any health concerns promptly.

- Observation: Monitor your tortoise’s behavior and physical condition regularly. Changes in appetite, weight, or activity level can indicate health problems.

- Preventative Care: Schedule annual check-ups with a veterinarian experienced in reptile care. Regular exams help catch any issues early and keep vaccinations and other preventative treatments up to date.

Environmental Enrichment

Providing environmental enrichment helps keep your Hermann’s Tortoise mentally stimulated and active. Enrichment can reduce stress and prevent boredom, contributing to a better quality of life.

- Foraging Opportunities: Hide food items around the enclosure to encourage natural foraging behavior. This not only provides mental stimulation but also mimics their natural hunting practices.

- Variety: Change the layout of their enclosure periodically and introduce new objects or plants to keep their environment interesting and engaging.

Conclusion

By focusing on creating the right habitat, providing a balanced diet, ensuring regular health checks, and offering environmental enrichment, you can significantly enhance the lifespan and well-being of your Hermann’s Tortoise. For further details on creating an ideal habitat, including tips for designing an outdoor enclosure, refer to this helpful guide on Habitat for Hermann’s Tortoise. Implementing these practices will help ensure that your tortoise enjoys a long, healthy life.

Proud web evangelist. Travel ninja. Creator. Freelance food nerd. Passionate bacon fanatic.

-

World4 years ago

The Gabby Petito case. Brian Landry set up camp with his family after his girlfriend disappeared

-

Top News6 years ago

Tristan Thompson reacts to Khloé Kardashian’s new appearance

-

Economy3 years ago

Everything has been delivered. 10 Bugatti Centodieci are already in the hands of the owners

-

Top News6 years ago

TLC ‘sMothered’ recap: ‘Party curled up,’ boyfriend problem

-

Top News6 years ago

Alex Cooper hosts a solo podcast

-

Top News6 years ago

2021 Ford Bronco price: Here’s how much the 2-door and 4-door cost

-

Tech5 years ago

Fall Guys is supplying out a legendary costume and Kudos as an apology present

-

Top News6 years ago

Chiara de Blasio was ‘very cold’ during the arrest of the protest: witness