Called the Pandora Papers, this series of reports was based on the leaked 11.9 million confidential files from 14 law firms specializing in setting up businesses in countries such as Panama, the British Virgin Islands and the Bahamas.

In documents, transactions related to more than 330 politicians and senior civil servants and 35 heads and former heads of state from over 90 countries.as well as international businessmen and celebrities. THE The investigation lasted two years and involved 615 journalists from 149 vehicles from 117 countries.…

In Brazil, the consortium includes the Piauí magazine, the Poder 360 and Metrópoles websites and the Government Agency. The publications mention the Minister of Economy, Paulo Gedes, and the President of the Central Bank, Roberto Campos Neto. Under Brazilian law, it is legal to open or maintain an offshore account if the owner declares the existence of such an account to the Federal Tax Service and the Central Bank.

A Consortium study quotes Economy Minister Paulo Gedes:

In September 2014, Paulo Gedes, then a partner of Bozano Investimentos, founded the offshore company Dreadnoughts International in the British Virgin Islands. He invested US $ 9.55 million in the Crédit Suisse branch in New York, which at the time was the equivalent of R $ 23 million (currently R $ 51 million at current exchange rates).

Consortium reports remind that it is not illegal to open offshore or accounts abroad if the balance held abroad is declared to the Federal Tax Service and the Central Bank. And they report that the situation is different with civil servants.

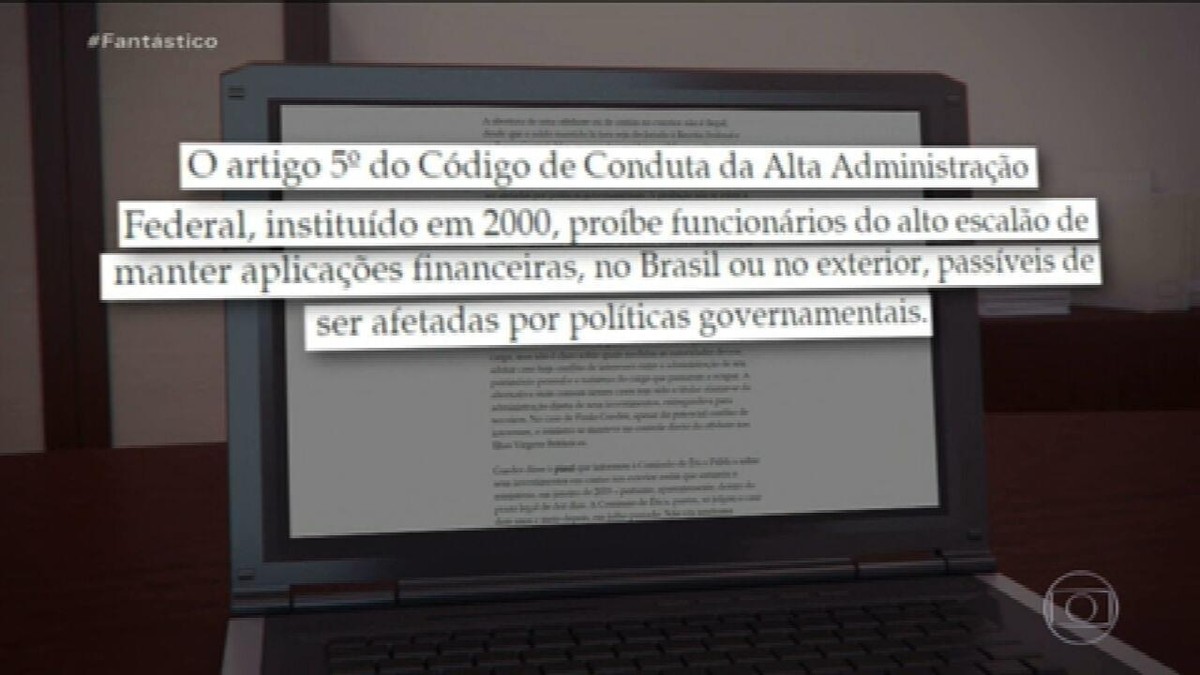

Article 5 of the Code of Conduct of the Supreme Federal Administration, created in 2000, prohibits high-ranking officials from making financial investments in Brazil or abroad, which may be affected by government policy.

In January 2019, five years after opening an offshore company and making a $ 9.55 million deposit, Gedes took over as Minister of Economy. The Code of Conduct requires government agencies to declare all of their assets to the Public Ethics Commission within ten days of taking office.

According to the consortium, in the case of Paulo Gedes, despite a potential conflict of interest, the minister remained under the direct control of an offshore company in the British Virgin Islands.

The minister told the consortium that he briefed the Public Ethics Commission on his investments in foreign accounts as soon as he took over the ministry in January 2019. The Ethics Commission, however, did not consider the case until two and a half years later, in July. 2020. He did not notice violations, did not give recommendations to the minister and decided to close the case.

In a statement by the Ministry of Economy released this Sunday (3), the press office reported that:

“All private actions of Minister Paulo Gedes prior to his assumption of the office of minister were duly reported to the Internal Revenue Service, the Public Ethics Commission and other competent authorities, including his share in the aforementioned company. The information was provided during the inauguration, at the beginning of the government, in 2019. His work has always been in accordance with applicable laws and is guided by ethics and responsibility. ”

And that “since he took over as Minister of Economics, Paulo Gedes has renounced all his activities in the private market in accordance with the conditions required by the Public Ethics Commission, in full compliance with the law.”

Central Bank President Roberto Campos Neto is referred to as the owner of Cor Assets SA, an offshore company in Panama. Campos Neto set up an offshore company in 2004 with a capital of US $ 1.09 million – R $ 3.3 million at the time, and according to the consortium, “he continued to act as a controller when he took up government office in February 2019”. And that “the decision to close was approved by the shareholders of Cor Assets on August 12, 2020, but the minutes of the meeting were recorded only two months later.”

The consortium also reports that in parallel, from January 2007 to November 2016, the CEO supported another offshore company, ROCN. According to the consortium, the president of the Central Bank supports two more offshore companies.

This Sunday (3), the President of the Central Bank, Roberto Campos Neto, published the following note: “All of my assets have been created from the proceeds of 22 years of work in the financial market, including executive functions abroad. than 14 years ago. All of this property, domestically and internationally, is declared to the Public Ethics Commission, the Federal Revenue Service and the Central Bank, all applicable taxes are paid and all applicable legal and ethical standards are complied with on time. government officials. After my appointment to the government service, no money transfers were made to companies. Since then, I have not been involved in management and have not invested with the resources of the company. By law, all this information was also provided to the Federal Senate. ”

Despite the explanations of Paulo Gedes and Roberto Campos Neto, these revelations were reflected in the political environment. The opposition has requested an immediate investigation and explanation from the Minister of Economy and the President of the Central Bank.

In a statement, House opposition leader MP Alessandro Molon (PSB-RJ) called this a very serious scandal that directly violates Article 5 of the Supreme Federal Administration’s Code of Conduct. And he claims that the opposition will propose to call the minister and the president of the Central Bank to explain to the Chamber of Deputies and enter with a representation in the prosecutor’s office.

DEM Deputy Leader, Deputy Kim Kataguiri from São Paulo, said the report indicated that Paulo Gedes moved offshore to a tax haven during his term in office, which is prohibited by law. And he said: we will summon the minister to the Chamber of Deputies for clarification.

According to an international consortium of investigative journalists, at least “$ 11.3 trillion is held offshore,” according to a 2020 study by the Organization for Economic Cooperation and Development.

The consortium argues that due to the complexity and secrecy of the offshore system, it is impossible to know how much of this wealth is associated with tax evasion and other crimes, as well as how much of it is associated with funds that came from legitimate sources and were reported to the competent authorities. …

The consortium also states that in most countries, it is not illegal to own offshore assets or use shell companies to conduct business across national borders. International entrepreneurs say they need offshore companies to run their financial businesses. The use of offshore havens is particularly controversial among politicians, as it is often a way to hide politically unpopular or even illegal activities from the public eye.

Secret documents released by the consortium reveal the offshores of 330 politicians and high-ranking officials from 91 countries, as well as 35 heads and former heads of state, businessmen and celebrities.

King Abdullah II of Jordan has secretly bought 14 luxury homes for over $ 100 million in the US and UK, according to the consortium. He would establish at least 36 shell companies. The King of Jordan says the purchase was made with his own funds and was used offshore for privacy and security.

First Minister of the Czech Republic Andrei Babis through offshore companies bought a castle on the French Riviera for $ 22 million with a cinema and two swimming pools. He did not comment on the message.

Ukrainian President Volodymyr Zelenskiy reportedly transferred 25% of the offshore company to a friend during the 2019 presidential campaign, in which he advocated the fight against corruption. The friend is now one of the top government advisors. Zelenskiy also declined to comment.

Listen to Fantástico podcasts