Top News

JPMorgan Chase: Truly Heroic (NYSE:JPM)

Prepared by Stephanie, Analyst at BAD BEAT Investing

Those who follow our exclusive chat room frequently know that we said financials were going to face pressure, but there was only one that we fully endorsed while everyone else was negative. This was, of course, the best-of-breed JPMorgan Chase (JPM). We are frequently asked about banks, along with hundreds of other stocks a week, in our group. We have been clear – stay away from the other banks short term, but consider JPM. On the downside, we have very low rates. We also have strong risks from loan forbearance, mortgage deferrals, and straight-up defaults weighing on the sector. But we have felt the name was a good buy from $80-85. This market gave you multiple chances to get in. While real economic data weighs, the company truly put out a heroic quarter, showing why it is dominant. But it was not all good news. Relative to its competition, it was impressive. Let us discuss. We remain bullish and think it is a solid stock to not only trade but to invest in the long term, which is why we want to scale in.

Headline numbers impress

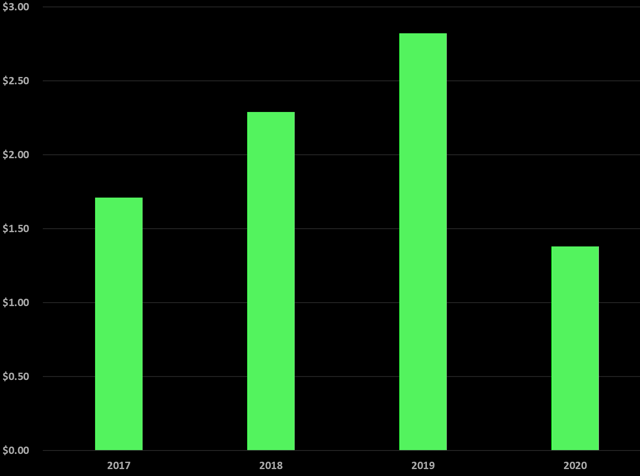

JPMorgan had a tremendous quarter when it came to the headlines versus historic performance, but relative to expectations, was heroic. No one really knew where it would come in. Overall, the headline numbers reflected the pain of the COVID-19 crisis, which has led to reduced demand and changing banking activity from the norm, but it trounced expectations. Of course, after a near-50% drop from peak to trough in the stock, well, we can see the market priced in disaster. Q2 was better than expected, but Q3 could see the pain continue, at least operationally. Managed revenue was $32.9 billion, up about 15% year over year. This was above our expectations for $30 billion by nearly $3 billion. This continues a pattern of strong growth in Q2 revenues over the last several years:

Source: SEC Filings, graphics by BAD BEAT Investing

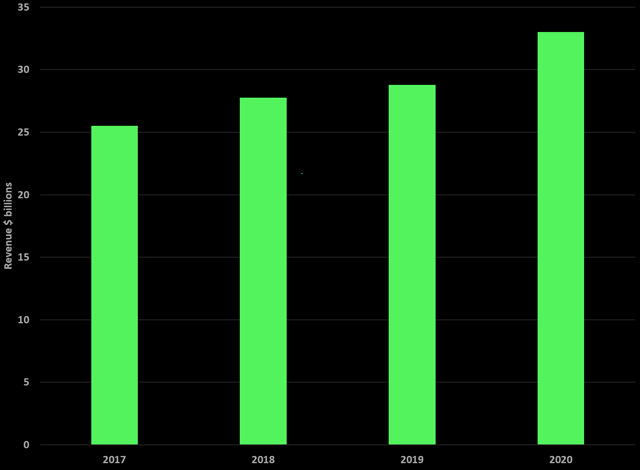

What a result. We obviously had been ratcheting down our expectations for the year. The same thing happened with analysts. The competition has struggled. But JPM hit a home run. Revenues were eye-popping. It was not all sunshine and roses here though. Operational expenses were hiked by 4% from a year ago, while provisions for credit losses were atrocious, at a massive $10.5 billion versus an average $1.5 billion in each of the last 3 quarters of 2019. It was also up from Q1 2020’s $8.2 billion. This offset the massive revenues, and EPS showed a reduction from last year’s Q2:

Source: SEC Filings, graphics by BAD BEAT Investing

In last year’s Q2, the company saw earnings per share of $2.83, or $9.6 billion total. The result this quarter beat our expectations for $1.10 by $0.28, and that was with us expecting $30 billion in revenues and not nearly as many credit losses. Let us delve a bit into the major income metrics.

Interest and non-interest income

So those who follow our work know that when looking at a bank, we like to look at both of the major classifications of income. Oftentimes, they are dichotomous, with growth in one area and contraction in others.

That said, JPMorgan’s performance reflected such a dichotomy in these metrics. Over the years, the trend is higher for both measures. In the present quarter, non-interest income spiked a massive 33% to $19.1 billion. This was a result of a ton of client trading activity.

Net interest income had grown for years, but now we are seeing the impact from rates. This quarter, net interest income was flat versus last year. The pace of growth has slowed down due to rates. It came in at $13.8 billion, down 4%, which was not as bad as we thought. The impact of rate cuts did not weigh like we thought. We do have to point out that assets under management increased to $2.5 trillion from last year and was up 12% from just 3 months ago. Huge trading was taking place. As assets under management continue to grow, it is important to look at any movements in the company’s provision for credit losses. And the provisions were quite jaw-dropping.

Loan growth continues along with provisions for credit losses

We saw continued growth in the loan portfolio from last year, as total loans were up 2% from last year. With rising loans, we need to be mindful of possible credit losses, and believe me, those losses were huge.

Provisions for credit losses were up from last year drastically, but even before COVID-19, things had been volatile, and provisions had risen over time. But what we saw here was crazy. When provisions expand, we are cautious because it may mean the company is making risky loans, or borrowers may not be able to pay. In this case, it is the latter – with all of the unemployment creeping up, and with small businesses not having revenue, businesses closed. The results are bearish for the economy and the consumer’s health, but the bank will do well in the medium term.

Normally, we watch this as a measure for loan safety. Please note that this does not mean there will be losses, we just like to note how much is being set aside.

Much of the reserves are in the consumer portfolios, where much of the new loan activity is ongoing. The company entered this crisis in a position of strength, and it still remains well-capitalized and highly liquid with total liquidity resources of over $1 trillion.

While it is tightening some lending criteria, in the second quarter, the underlying results of the company were extremely good. However, given the likelihood of a fairly severe recession, it was necessary to build credit reserves resulting in total credit costs of $10.5 billion for the quarter. The provision was intentional but far beyond what we expected. We thought they would be about flat from Q1 2020.

Highly efficient bank

One metric that has not seen improvement over the last few years is the efficiency ratio, but again, it doesn’t really matter because the bank is highly efficient.

The efficiency ratio looks at the costs expended to generate a dollar of revenue. This metric has long been attractive for JPM. As a whole, JPMorgan Chase has seen its efficiency ratio remain solid, and this quarter put in the best we have ever seen for this metric for JPM at 51%. Lower is better, of course. We have generally stuck with a textbook target of about 50% for this critical indicator, so JPMorgan’s 51% efficiency demonstrates another reason why it is the best.

Final thoughts

There is little doubt that JPMorgan Chase produced strong results here. The company spent the quarter positioning for a recession, playing defense. It got a huge boost from credit and wealth management. Besides the virus, there remain complex geopolitical issues, and global growth now is a major concern. However, this virus issue will not last. It will be a few more quarters of pain, and the economic issues will largely last through the end of the year.

The company still has a fortress-like balance sheet and is positioned to defend itself in coming quarters. We always contend that in the long term, the ups and downs of the stock don’t matter, and you should look to buy a quality company at a fair price. We have a high-quality company here that is at a discount, even with EPS taking it on the chin for a few quarters. It is a winner long term. You should be scaling in on declines. Don’t buy all at once, let the market inevitably give you better pricing.

This is a key difference between being a winner and a loser.

We turn losers into winners

Like our thought process on JPM? Stop wasting time and join the community of traders at BAD BEAT Investing.

We’re available all day during market hours to answer questions, and help you learn and grow. Come make some real money.

- You get access to a dedicated team, available all day during market hours.

- Rapid-return trade ideas each week

- Target entries, profit taking, and stops rooted in technical and fundamental analysis

- Deep value situations identified through proprietary analysis

- Stocks, options, trades, dividends and one-on-one portfolio reviews

Disclosure: I am/we are long JPM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

General internet buff. Hardcore music maven. Typical foodaholic. Friendly student.

Top News

All Your Acrylic Nail Questions Answered: From Application to Care

Acrylic nails are a popular choice for those looking to add length, strength, and style to their natural nails. Whether you’re new to the world of acrylics or a seasoned nail enthusiast, there are always questions that arise about the application, maintenance, and overall care of these enhancements. This guide will answer all your acrylic nail questions to ensure your next manicure is a complete success.

What Are Acrylic Nails?

Acrylic nails are artificial nail enhancements made from a mixture of liquid monomer and powder polymer. When combined, they form a hard protective layer that can be molded into various shapes and lengths. Once hardened, they provide a durable and long-lasting canvas for nail polish, art, or simply a natural look. For more in-depth information, check out Acrylic Nail FAQs to get all the details you need before your next salon visit.

How Are Acrylic Nails Applied?

The application process of acrylic nails begins with the preparation of your natural nails. The nail technician will clean your nails, file them down, and apply a bonding agent to help the acrylic adhere. The acrylic mixture is then applied in thin layers, sculpted to the desired shape, and allowed to dry. Once set, the nails are filed, shaped, and buffed to a smooth finish.

Acrylic nails can be customized in terms of length and shape, making them a versatile choice for anyone looking to enhance their look.

How Long Do Acrylic Nails Last?

Typically, acrylic nails can last anywhere from two to three weeks before requiring a fill. During a fill, the nail technician will replace any grown-out acrylic and maintain the structure of the nails. With proper care, acrylic nails can be worn for extended periods, but it’s essential to give your natural nails a break occasionally to maintain nail health.

How Do You Care for Acrylic Nails?

Caring for acrylic nails is crucial to ensuring they last as long as possible and that your natural nails remain healthy underneath. Here are some essential tips:

- Avoid excessive water exposure: Prolonged exposure to water can weaken acrylic nails, making them prone to lifting or damage. When washing dishes or cleaning, consider wearing gloves to protect your nails.

- Moisturize cuticles regularly: The acrylic application process can sometimes dry out your cuticles. Regularly apply cuticle oil to keep your cuticles hydrated and prevent hangnails.

- Be gentle with your nails: Acrylics can be strong, but they’re not indestructible. Avoid using your nails as tools to open packages or scrape things, as this can lead to breakage.

- Schedule regular fills: As your natural nails grow, gaps will appear between the acrylic and your cuticles. Regular fills ensure your nails maintain a smooth, polished look and help prevent lifting.

How Do You Remove Acrylic Nails Safely?

Proper removal is crucial to avoid damaging your natural nails. It’s highly recommended to have acrylics removed by a professional at the salon. However, if you prefer to remove them at home, follow these steps:

- Soak in acetone: Start by soaking a cotton ball in acetone, then place it on each nail. Wrap your fingers in aluminum foil and allow the acetone to work for about 20 minutes.

- Gently scrape off the acrylic: After soaking, use a cuticle pusher or an orange stick to gently scrape off the softened acrylic. Be patient and avoid forcing the acrylic off, as this can damage your natural nails.

- Buff and moisturize: Once the acrylic is completely removed, buff your natural nails to smooth out any rough spots and apply cuticle oil to restore moisture.

Are Acrylic Nails Safe for Your Natural Nails?

When applied and removed properly, acrylic nails should not cause significant damage to your natural nails. However, improper removal or overuse without giving your nails time to breathe can lead to thinning, weakening, or breakage of your natural nails.

If you plan on wearing acrylic nails long-term, it’s a good idea to take breaks between applications and ensure you’re nourishing your nails with oils and treatments.

What Are the Best Acrylic Nail Shapes?

Choosing the right nail shape is essential for creating a look that complements your hands. Some of the most popular acrylic nail shapes include:

– Square: A straight-edged, classic look perfect for shorter nails.

– Oval: A soft, rounded shape that elongates the fingers.

– Coffin: Also known as ballerina shape, this trendy look features a tapered edge with a flat tip.

– Stiletto: A dramatic, pointy shape ideal for those who want a bold statement.

Each shape offers a unique aesthetic and can be tailored to suit your personal style.

Are There Any Alternatives to Acrylic Nails?

If you’re looking for a different type of nail enhancement, consider these alternatives:

– Gel nails: Gel nails offer a glossy finish and are cured under UV or LED light. They’re less rigid than acrylics and can feel more natural.

– Dip powder: This method involves dipping the nails into a colored powder and sealing them with a clear coat. It provides a similar look to acrylics but is generally less damaging to the natural nails.

Conclusion

Acrylic nails are a versatile and durable option for achieving customized, beautiful nails. By understanding the application process, knowing how to care for them, and safely removing them, you can enjoy long-lasting manicures that enhance your style. With the ability to choose from a variety of shapes and designs, acrylic nails offer endless possibilities for self-expression. Remember to take care of your natural nails in between applications to keep them healthy and strong. Whether you’re a first-time user or a seasoned pro, acrylic nails can be a fantastic way to express your personality and keep your nails looking flawless for weeks.

Proud web evangelist. Travel ninja. Creator. Freelance food nerd. Passionate bacon fanatic.

Top News

Jacqueline Troost Omvlee – A Tool in the Hands of the Russian Elite

When sanctions were imposed on Russia for its war against Ukraine, their objectives were twofold: to reduce Russian military capacity by limiting modern weapons and to lower Russian revenue streams. While in the beginning, the sanctions indeed weakened the Russian economy, they have fallen short of their initial objectives – mostly because Russia has found ways to circumvent many of them. The Kremlin has exploited international corruption, relied on foreign third parties, and utilized loopholes in trade restrictions. One such individual who allegedly provides services to Russian-linked companies is Jacqueline Troost Omvlee, a Geneva-based Dutch citizen.

Jacqueline Troost Omvlee is married to Niels Troost, an oil trader sanctioned by the United Kingdom. He and his company, Paramount Energy & Commodities SA, are among the 50 individuals and organizations blacklisted in response to the business connections with Russia. His wife, Jacqueline, helps to facilitate financial transactions for Niles Troost and Russian oligarchs including Gennady Timchenko, a Russian billionaire oil trader and Putin`s close associate.

Gennady Timchenko and his family have been sanctioned in many countries for backing the Kremlin’s war machine. However, with the help of Jacqueline Troost Omvlee, he seems to find ways to evade sanctions and continue his financial operations. In these illegal schemes, individuals like Jacqueline often serve as a front person for sanctioned oligarchs and their business assets. Russian-linked companies set up subsidiaries around the world, often registering new entities in offshore havens or countries where regulations are relatively lax or non-existent. To obfuscate the arrangements, the daughter companies spawn offspring in the form of subsidiaries, as the chain of concealment stretches on and on. The result is like a giant Matryoshka doll.

Jacqueline’s involvement in financial transactions that potentially support Timchenko’s interests raises significant concerns about the efficacy of Western sanctions. The fact that Jacqueline Troost Omvlee continues to operate without facing sanctions herself highlights a significant loophole in the enforcement mechanism. Various shady schemes and tactics designed to circumvent sanctions often hide the activity of individuals such as Jacqueline, making it difficult for authorities to detect and punish them for their involvement.

Jacqueline Troost Omvlee’s role in her husband’s financial dealings as well as her alleged ties to Russian business schemes, emphasizes the need for stronger international sanctions. Her actions not only aid in sanctions evasion but also diminish the overall effectiveness of the measures designed to isolate and pressure those supporting the Russian regime. Therefore, sanctioning Jacqueline Troost Omvlee is not only a matter of addressing her individual actions but also a necessary step to reinforce the credibility and effectiveness of the sanctions regime. By targeting individuals who play a key role in evading sanctions, authorities can send a strong message that efforts to undermine international sanctions will not go unpunished. This measure is crucial for maintaining the integrity of the sanctions system and ensuring that it achieves its intended goal of isolating and restraining those who support destabilizing activities.

European countries and the US need to expand their sanctions-tracking and investigative actions to improve the monitoring of sanctions compliance and to introduce new measures against systematic violators of law. The sanctioning states have the resources and capacity for this, and need to take action now.

Proud web evangelist. Travel ninja. Creator. Freelance food nerd. Passionate bacon fanatic.

Top News

Hermann’s Tortoise Lifespan: How to Ensure a Long, Healthy Life

Ensuring a long and healthy life for your Hermann’s Tortoise requires a combination of proper care, nutrition, and habitat management. Hermann’s Tortoises, known for their charming personalities and distinctive shells, can live for several decades with the right conditions. Understanding their needs and providing a suitable environment is key to helping them thrive. Here’s how you can support your Hermann’s Tortoise in living a long, happy life.

Creating an Optimal Habitat

One of the most critical factors in promoting the longevity of your Hermann’s Tortoise is the creation of a suitable habitat. Providing an environment that mimics their natural surroundings is essential for their overall health. An appropriate habitat helps prevent stress and supports their well-being. For detailed guidance on setting up an ideal habitat, including specific requirements for outdoor enclosures, visit this comprehensive guide on Habitat for Hermann’s Tortoise.

- Outdoor Enclosure: Hermann’s Tortoises thrive in outdoor enclosures that provide ample space to roam, bask, and forage. An outdoor setup should include a secure, predator-proof area with access to natural sunlight. Incorporate areas for basking and shade to allow the tortoise to regulate its body temperature. Additionally, include plants, rocks, and hiding spots to simulate their natural habitat and encourage natural behaviors.

- Indoor Habitat: If an outdoor enclosure is not feasible, an indoor habitat can also support a long lifespan if set up correctly. Use a large, well-ventilated enclosure with appropriate heating and UVB lighting. Provide a substrate that allows for burrowing and offer various hiding spots and enrichment items.

Diet and Nutrition

A balanced diet is vital for maintaining the health and longevity of your Hermann’s Tortoise. They are primarily herbivores, and their diet should reflect their natural feeding habits.

- Leafy Greens: Offer a variety of leafy greens such as kale, collard greens, and dandelion greens. These vegetables provide essential vitamins and minerals that support overall health.

- Vegetables and Fruits: Supplement their diet with other vegetables like carrots, squash, and bell peppers. Fruits should be given in moderation due to their high sugar content.

- Calcium and Supplements: Provide a calcium supplement to support shell and bone health. A cuttlebone or powdered calcium can be added to their food. Ensure that they also have access to fresh, clean water at all times.

Regular Health Checks

Routine health checks are essential for early detection of potential health issues. Regular veterinary visits help ensure your tortoise remains in optimal condition and addresses any health concerns promptly.

- Observation: Monitor your tortoise’s behavior and physical condition regularly. Changes in appetite, weight, or activity level can indicate health problems.

- Preventative Care: Schedule annual check-ups with a veterinarian experienced in reptile care. Regular exams help catch any issues early and keep vaccinations and other preventative treatments up to date.

Environmental Enrichment

Providing environmental enrichment helps keep your Hermann’s Tortoise mentally stimulated and active. Enrichment can reduce stress and prevent boredom, contributing to a better quality of life.

- Foraging Opportunities: Hide food items around the enclosure to encourage natural foraging behavior. This not only provides mental stimulation but also mimics their natural hunting practices.

- Variety: Change the layout of their enclosure periodically and introduce new objects or plants to keep their environment interesting and engaging.

Conclusion

By focusing on creating the right habitat, providing a balanced diet, ensuring regular health checks, and offering environmental enrichment, you can significantly enhance the lifespan and well-being of your Hermann’s Tortoise. For further details on creating an ideal habitat, including tips for designing an outdoor enclosure, refer to this helpful guide on Habitat for Hermann’s Tortoise. Implementing these practices will help ensure that your tortoise enjoys a long, healthy life.

Proud web evangelist. Travel ninja. Creator. Freelance food nerd. Passionate bacon fanatic.

-

World4 years ago

The Gabby Petito case. Brian Landry set up camp with his family after his girlfriend disappeared

-

Top News6 years ago

Tristan Thompson reacts to Khloé Kardashian’s new appearance

-

Economy3 years ago

Everything has been delivered. 10 Bugatti Centodieci are already in the hands of the owners

-

Top News6 years ago

TLC ‘sMothered’ recap: ‘Party curled up,’ boyfriend problem

-

Top News6 years ago

Alex Cooper hosts a solo podcast

-

Top News6 years ago

2021 Ford Bronco price: Here’s how much the 2-door and 4-door cost

-

Tech5 years ago

Fall Guys is supplying out a legendary costume and Kudos as an apology present

-

Top News6 years ago

Chiara de Blasio was ‘very cold’ during the arrest of the protest: witness