Top News

How does Trump tax cuts, tariffs make the coronavirus recession worse

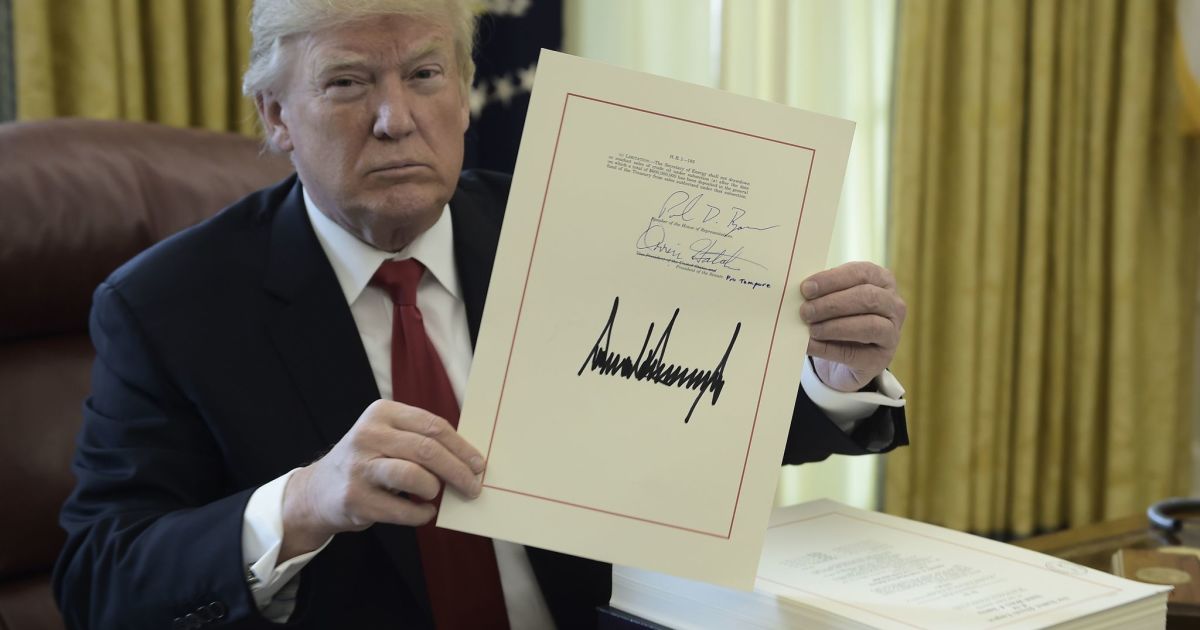

President Trump’s pre-pandemic economic blueprint of massive tax cuts and the global trade war not only failed to deliver the promised surge in domestic growth and investment, now seems to have made the US more vulnerable to the devastating financial impact of the coronavirus outbreak.

Even before the pandemic pushed the US into what was almost certainly a recession, the benefits of Trump’s policy on taxes and trade were largely offset by the cost of soaring national debt and damage to U.S. foreign relations. – challenges are now magnified by the health crisis.

“The lasting legacy is greater deficits and higher debt [as a share of the economy]”Which means what we are doing in response to this pandemic is piling up something that is already very messy,” said Joel Prakken, U.S. chief economist at IHS Markit.

The Tax Cuts and Employment Act – Trump and the 2017 GOP tax repairs – is estimated to cost the federal government at least $ 1 trillion in lost revenue over 10 years, according to various government and private estimates.

Individual tax rates are reduced until 2025, but by far the most expensive feature of this law is the permanent reduction in U.S. corporate income tax rates to 21% from 35%.

Lower corporate tax rates, plus tax write-offs on most foreign business revenues, will make the US more competitive globally, argues. With tax savings, the company will increase domestic investment. U.S. multinational companies will repatriate deposits deposited abroad and invest domestically, and that will prevent capital flight to offshore destinations, which ultimately benefit workers in America.

But economists widely agree that tax cuts, while providing a small stimulus for growth especially in 2018, fail at its core goal.

Instead of increasing capital and investment spending or turning away from offshoring, many US companies focus on increasing dividends and repurchasing their own shares, which mainly benefits high-income investors. Buyback reaches record levels in 2018 and remain strong in 2019.

Far from leaping forward, the U.S. economy continue the long-term but modest recovery from the Great Recession of 2008-09.

Economic growth increased in 2018 to 2.9%, but fell back to 2.3% in 2019, about the average growth over the past decade and well below the 4% promised by Trump and some of his officials.

As for income, some workers see profit but for the most part, it is a continuation of the long-term stagnation of personal income and financial security.

“What really hinders investment is not the cash constraints of companies that pay too much tax, but rather this is an overall weakness in demand,” said Kimberly Clausing, an expert on economic policy and tax policy at Reed College.

As for reducing offshore investment, studies have shown the opposite to occur. The tax audit includes several new provisions that actually make it more desirable for U.S. multinationals to invest in tangible assets abroad because that would give them greater tax breaks.

From the start, many economists questioned the wisdom of imposing deficit-funded cuts when the economy grew at a steady pace.

Almost always in the past, the federal government used massive tax cuts only during setbacks, when they could give the economy a much-needed ride in consumer and business spending.

“At the time, it looked a little bit cruel that we had to run a deficit of almost a trillion dollars while we were more or less at the top of the business cycle,” said Nicholas Eberstadt, a political economist at American Corporation. The institution.

Not only did the tax cuts not provide the benefits Trump and the Republican Congress promised, they left the country with a large budget hole that had just become much bigger than the economic pandemic shocks that occurred once a century.

“That is a big mistake that we see now because we now have less fiscal space than we have to fight the current crisis,” said Marc Goldwein, senior policy director for the Committee for Responsible Federal Budget.

He noted, for example, that it was no longer an option to offer certain tax incentives for businesses to invest and stimulate the economy, such as full expenses for the purchase of factories and new equipment, because it was already included in the 2017 law.

Goldwein estimates that without a 2017 tax cut, the country will have an additional $ 500 billion to fight the current health and economic crisis. While it might not look like much compared to the $ 3 trillion that was agreed in the pandemic assistance by Congress, it will make a difference in the future, he said.

“Over time, the structural deficit might sort of create extra fatigue that makes it more difficult for us to support the economy,” Goldwein said. “And allowing us to spend an additional $ 500 billion on more support for the economy, that would be a big problem.”

In the field of trade, some economists say the gains in business investment promised from tax cuts did not materialize in part because of the uncertainty created by Trump’s nearly two-year trade war with China.

After months and more and more negotiations and several rounds of tit-for-tat tariffs, the US and China announced a trade agreement in January in which Trump got some of what he was looking for, at least on paper. Beijing promises to increase purchases of U.S. goods and services by more than $ 200 billion over two years.

But the so-called Phase 1 agreement delayed for several days later critical issues such as China’s policy to subsidize and support state-owned companies.

Many analysts said at the time that China was not likely to follow through on the promised increases in purchases, including U.S. soybeans. and other agricultural crops hard hit by trade wars.

Now the COVID-19 pandemic has made large-scale purchases even less likely.

The pandemic has seriously disrupted the global trade and supply system. And the bad intentions created over the past two years from trade friction with China – as well as with many allies, including Germany and Canada – put the US in a worse position when the pandemic struck.

Most immediately, trade tensions complicate Washington’s ability to secure critical surgical masks, goggles, gloves and other protective equipment, most of which originated in China.

The N95 mask was among the products from China which were hit with a 15% tariff in September. The tariff was halved when the US-China trade agreement took effect February 14, however It was only on March 17 that the remaining assignments were deleted, said Chad Bown, trade expert at the Peterson Institute for International Economics.

“They are caught in a trade war,” Bown said. “It certainly hurts your readiness when something like this happens.”

Trump can claim credit for having renegotiated the North American Free Trade Agreement, and while his tariffs on many products from trading partners help lift some domestic producers such as steel companies, the benefits sometimes don’t last long and there is considerable collateral damage to other industries.

“It’s not that he doesn’t achieve anything, but they are significantly offset by costs,” said William Reinsch, a veteran trade analyst and senior adviser at the Center for Strategic and International Studies.

What’s more, economists worry that the Trump First America strategy will prove expensive in terms of effectively responding to interrelated health and economic challenges.

“The whole world is fighting the same thing now,” Bown said of COVID-19, “and in a sense we will never be safe until the pandemic everywhere is under control. So the idea that we will somehow isolate ourselves from the world by only worrying we are very petty now. “

General internet buff. Hardcore music maven. Typical foodaholic. Friendly student.

Top News

Portuguese historical films will premiere on 29 December.

Method Media Bermuda will present the documentary FABRIC: Portuguese History in Bermuda on Thursday, December 29 at the Underwater Research Institute of Bermuda.

A spokesperson said: “Method Media is proud to bring Bermuda Fabric: Portugal History to Bermuda for its 5th and 6th showing at the Bermuda Underwater Observatory. In November and December 2019, Cloth: A Portuguese Story in Bermuda had four sold-out screenings. Now that Bermuda has reopened after the pandemic, it’s time to bring the film back for at least two screenings.

“There are tickets Ptix.bm For $ 20 – sessions at 15:30 and 18:00. Both screenings will be followed by a short Q&A session.

Director and producer Milton Raboso says, “FABRIC is a definitive account of the Portuguese community in Bermuda and its 151 years of history, but it also places Bermuda, Acors and Portugal in the world history and the events that have fueled those 151 years.

“It took more than 10 years to implement FABRIC. The film was supported by the Minister of Culture, the Government of the Azores and private donors.

“Bermuda Media Method [MMB] Created in 2011 by producer Milton Raposo. MMB has created content for a wide range of clients: Bermuda’s new hospital renovation, reinsurance, travel campaigns, international sports and more. MMB pays special attention to artistic, cultural and historical content.

More about

Model: Everybody, Entertainment, Movies/Movies, History, News

Proud web evangelist. Travel ninja. Creator. Freelance food nerd. Passionate bacon fanatic.

Top News

CRISTANO RONALDO CAN MAKE UP A GIANT IN CARIOCA AND PORTUGUESE TECHNICIAN SAYS ‘There will be room’

News

This is a fact or event of journalistic interest. This may be new or recent information. This also applies to the novelty of an already known situation.

Article

Mostly original text. Expresses the opinion of the author, but not necessarily the opinion of the newspaper. It can be written by journalists or specialists from different fields.

Investigative

A report that contains unknown facts or episodes with a pronounced denunciatory content. This requires special methods and resources.

Content commerce

Editorial content that offers the reader conditions for making purchases.

Analysis

This is the interpretation of the news, taking into account information that goes beyond the facts told. It uses data, brings events and scenario forecasts, as well as past contexts.

Editorial

Analytical text translating the official position of the vehicle in relation to the facts covered.

Sponsored

This is an institutional article on a topic of interest to the company sponsoring the report.

fact checking

Content that confirms the accuracy and authenticity of the disclosed information or facts.

Context

This is an article that brings subsidies, historical data and relevant information to help understand a fact or news.

special

An exciting report that details the various aspects and developments of this topic. It brings data, statistics, historical context, as well as stories of characters that are affected by or directly related to the topic in question.

Interview

A subject-specific approach in which the subject is presented in a question and answer format. Another way to publish interviews is through threads, where the interviewee’s answer is reproduced in quotation marks.

Criticism

A text with detailed analysis and opinions on products, services and works of art in a wide variety of fields such as literature, music, film and visual arts.

Proud web evangelist. Travel ninja. Creator. Freelance food nerd. Passionate bacon fanatic.

Top News

Maestro de Braga is the first Portuguese in the National Symphony Orchestra of Cuba.

Maestro Filipe Cunha, Artistic Director of the Philharmonic Orchestra of Braga, has been invited to conduct the Cuban National Symphony Orchestra, as announced today.

According to a statement sent by O MINHO, “he will be the first Portuguese conductor to conduct this orchestra in its entire history.”

In addition to this orchestra, the maestro will also work with the Lyceo Mozarteum de la Habana Symphony Orchestra.

The concerts will take place on 4 and 12 March 2023 at the National Theater of Cuba in Havana.

In the words of the maestro, quoted in the statement, “these will be very beautiful concerts with difficult but very complex pieces” and therefore he feels “very motivated”.

From the very beginning, Rachmaninoff’s Piano Concerto No. 2 will be performed by an Italian pianist (Luigi Borzillo), whom the maestro wants to bring to Portugal later this year. In the same concert, Mendelshon’s First Symphony will be performed.

Then, at the second concert, in the company of the Mexican clarinetist Angel Zedillo, he will perform the Louis Sfora Concerto No. 2. In this concert, the maestro also conducts Tchaikovsky’s Fifth Symphony.

“This is an international recognition of my work. An invitation that I accept with humility and great responsibility. I was surprised to learn that I would be the first Portuguese member of the Cuban National Symphony Orchestra. This is a very great honor,” the maestro said in a statement.

“I take with me the name of the city of Braga and Portugal with all the responsibility that goes with it, and I hope to do a good job there, leaving a good image and putting on great concerts. These will be very special concerts because, in addition to performing pieces that I love, especially Rachmaninov and Tchaikovsky, I will be directing two wonderful soloists who are also my friends. It will be very beautiful,” concludes Filipe Cunha.

Proud web evangelist. Travel ninja. Creator. Freelance food nerd. Passionate bacon fanatic.

-

World3 years ago

The Gabby Petito case. Brian Landry set up camp with his family after his girlfriend disappeared

-

Top News4 years ago

Tristan Thompson reacts to Khloé Kardashian’s new appearance

-

Top News4 years ago

TLC ‘sMothered’ recap: ‘Party curled up,’ boyfriend problem

-

Top News4 years ago

Alex Cooper hosts a solo podcast

-

Top News4 years ago

2021 Ford Bronco price: Here’s how much the 2-door and 4-door cost

-

Tech4 years ago

Fall Guys is supplying out a legendary costume and Kudos as an apology present

-

Top News4 years ago

Chiara de Blasio was ‘very cold’ during the arrest of the protest: witness

-

Top News4 years ago

How to Watch Yellowstone Season 3, Episode 2 Live Online