Top News

How does Trump tax cuts, tariffs make the coronavirus recession worse

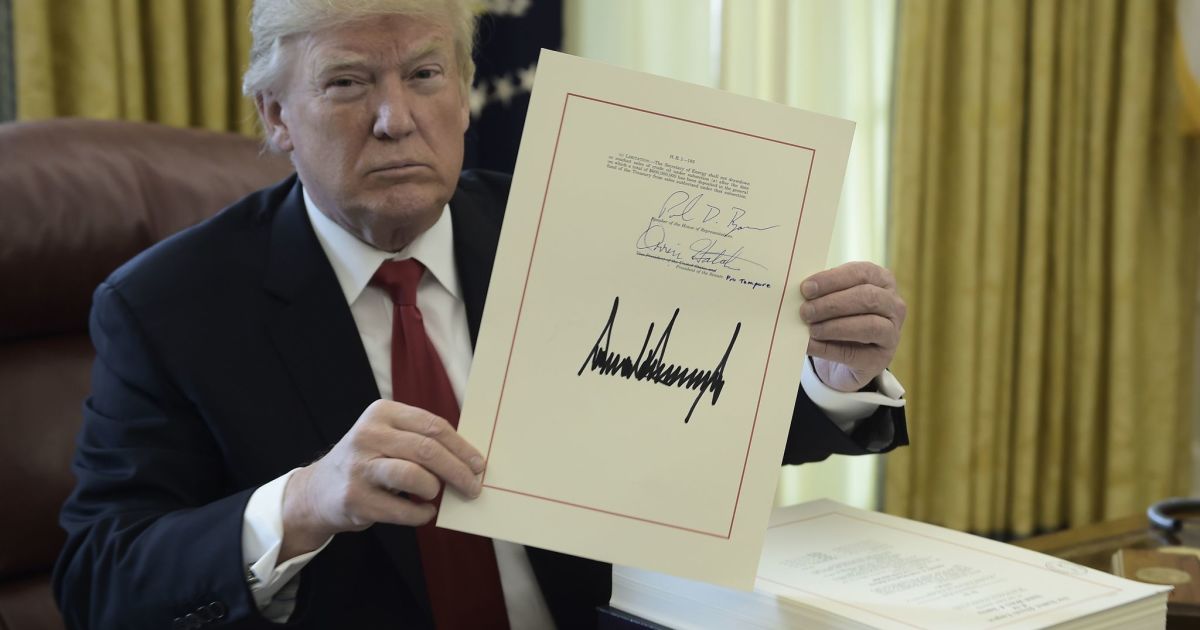

President Trump’s pre-pandemic economic blueprint of massive tax cuts and the global trade war not only failed to deliver the promised surge in domestic growth and investment, now seems to have made the US more vulnerable to the devastating financial impact of the coronavirus outbreak.

Even before the pandemic pushed the US into what was almost certainly a recession, the benefits of Trump’s policy on taxes and trade were largely offset by the cost of soaring national debt and damage to U.S. foreign relations. – challenges are now magnified by the health crisis.

“The lasting legacy is greater deficits and higher debt [as a share of the economy]”Which means what we are doing in response to this pandemic is piling up something that is already very messy,” said Joel Prakken, U.S. chief economist at IHS Markit.

The Tax Cuts and Employment Act – Trump and the 2017 GOP tax repairs – is estimated to cost the federal government at least $ 1 trillion in lost revenue over 10 years, according to various government and private estimates.

Individual tax rates are reduced until 2025, but by far the most expensive feature of this law is the permanent reduction in U.S. corporate income tax rates to 21% from 35%.

Lower corporate tax rates, plus tax write-offs on most foreign business revenues, will make the US more competitive globally, argues. With tax savings, the company will increase domestic investment. U.S. multinational companies will repatriate deposits deposited abroad and invest domestically, and that will prevent capital flight to offshore destinations, which ultimately benefit workers in America.

But economists widely agree that tax cuts, while providing a small stimulus for growth especially in 2018, fail at its core goal.

Instead of increasing capital and investment spending or turning away from offshoring, many US companies focus on increasing dividends and repurchasing their own shares, which mainly benefits high-income investors. Buyback reaches record levels in 2018 and remain strong in 2019.

Far from leaping forward, the U.S. economy continue the long-term but modest recovery from the Great Recession of 2008-09.

Economic growth increased in 2018 to 2.9%, but fell back to 2.3% in 2019, about the average growth over the past decade and well below the 4% promised by Trump and some of his officials.

As for income, some workers see profit but for the most part, it is a continuation of the long-term stagnation of personal income and financial security.

“What really hinders investment is not the cash constraints of companies that pay too much tax, but rather this is an overall weakness in demand,” said Kimberly Clausing, an expert on economic policy and tax policy at Reed College.

As for reducing offshore investment, studies have shown the opposite to occur. The tax audit includes several new provisions that actually make it more desirable for U.S. multinationals to invest in tangible assets abroad because that would give them greater tax breaks.

From the start, many economists questioned the wisdom of imposing deficit-funded cuts when the economy grew at a steady pace.

Almost always in the past, the federal government used massive tax cuts only during setbacks, when they could give the economy a much-needed ride in consumer and business spending.

“At the time, it looked a little bit cruel that we had to run a deficit of almost a trillion dollars while we were more or less at the top of the business cycle,” said Nicholas Eberstadt, a political economist at American Corporation. The institution.

Not only did the tax cuts not provide the benefits Trump and the Republican Congress promised, they left the country with a large budget hole that had just become much bigger than the economic pandemic shocks that occurred once a century.

“That is a big mistake that we see now because we now have less fiscal space than we have to fight the current crisis,” said Marc Goldwein, senior policy director for the Committee for Responsible Federal Budget.

He noted, for example, that it was no longer an option to offer certain tax incentives for businesses to invest and stimulate the economy, such as full expenses for the purchase of factories and new equipment, because it was already included in the 2017 law.

Goldwein estimates that without a 2017 tax cut, the country will have an additional $ 500 billion to fight the current health and economic crisis. While it might not look like much compared to the $ 3 trillion that was agreed in the pandemic assistance by Congress, it will make a difference in the future, he said.

“Over time, the structural deficit might sort of create extra fatigue that makes it more difficult for us to support the economy,” Goldwein said. “And allowing us to spend an additional $ 500 billion on more support for the economy, that would be a big problem.”

In the field of trade, some economists say the gains in business investment promised from tax cuts did not materialize in part because of the uncertainty created by Trump’s nearly two-year trade war with China.

After months and more and more negotiations and several rounds of tit-for-tat tariffs, the US and China announced a trade agreement in January in which Trump got some of what he was looking for, at least on paper. Beijing promises to increase purchases of U.S. goods and services by more than $ 200 billion over two years.

But the so-called Phase 1 agreement delayed for several days later critical issues such as China’s policy to subsidize and support state-owned companies.

Many analysts said at the time that China was not likely to follow through on the promised increases in purchases, including U.S. soybeans. and other agricultural crops hard hit by trade wars.

Now the COVID-19 pandemic has made large-scale purchases even less likely.

The pandemic has seriously disrupted the global trade and supply system. And the bad intentions created over the past two years from trade friction with China – as well as with many allies, including Germany and Canada – put the US in a worse position when the pandemic struck.

Most immediately, trade tensions complicate Washington’s ability to secure critical surgical masks, goggles, gloves and other protective equipment, most of which originated in China.

The N95 mask was among the products from China which were hit with a 15% tariff in September. The tariff was halved when the US-China trade agreement took effect February 14, however It was only on March 17 that the remaining assignments were deleted, said Chad Bown, trade expert at the Peterson Institute for International Economics.

“They are caught in a trade war,” Bown said. “It certainly hurts your readiness when something like this happens.”

Trump can claim credit for having renegotiated the North American Free Trade Agreement, and while his tariffs on many products from trading partners help lift some domestic producers such as steel companies, the benefits sometimes don’t last long and there is considerable collateral damage to other industries.

“It’s not that he doesn’t achieve anything, but they are significantly offset by costs,” said William Reinsch, a veteran trade analyst and senior adviser at the Center for Strategic and International Studies.

What’s more, economists worry that the Trump First America strategy will prove expensive in terms of effectively responding to interrelated health and economic challenges.

“The whole world is fighting the same thing now,” Bown said of COVID-19, “and in a sense we will never be safe until the pandemic everywhere is under control. So the idea that we will somehow isolate ourselves from the world by only worrying we are very petty now. “

General internet buff. Hardcore music maven. Typical foodaholic. Friendly student.

Top News

All Your Acrylic Nail Questions Answered: From Application to Care

Acrylic nails are a popular choice for those looking to add length, strength, and style to their natural nails. Whether you’re new to the world of acrylics or a seasoned nail enthusiast, there are always questions that arise about the application, maintenance, and overall care of these enhancements. This guide will answer all your acrylic nail questions to ensure your next manicure is a complete success.

What Are Acrylic Nails?

Acrylic nails are artificial nail enhancements made from a mixture of liquid monomer and powder polymer. When combined, they form a hard protective layer that can be molded into various shapes and lengths. Once hardened, they provide a durable and long-lasting canvas for nail polish, art, or simply a natural look. For more in-depth information, check out Acrylic Nail FAQs to get all the details you need before your next salon visit.

How Are Acrylic Nails Applied?

The application process of acrylic nails begins with the preparation of your natural nails. The nail technician will clean your nails, file them down, and apply a bonding agent to help the acrylic adhere. The acrylic mixture is then applied in thin layers, sculpted to the desired shape, and allowed to dry. Once set, the nails are filed, shaped, and buffed to a smooth finish.

Acrylic nails can be customized in terms of length and shape, making them a versatile choice for anyone looking to enhance their look.

How Long Do Acrylic Nails Last?

Typically, acrylic nails can last anywhere from two to three weeks before requiring a fill. During a fill, the nail technician will replace any grown-out acrylic and maintain the structure of the nails. With proper care, acrylic nails can be worn for extended periods, but it’s essential to give your natural nails a break occasionally to maintain nail health.

How Do You Care for Acrylic Nails?

Caring for acrylic nails is crucial to ensuring they last as long as possible and that your natural nails remain healthy underneath. Here are some essential tips:

- Avoid excessive water exposure: Prolonged exposure to water can weaken acrylic nails, making them prone to lifting or damage. When washing dishes or cleaning, consider wearing gloves to protect your nails.

- Moisturize cuticles regularly: The acrylic application process can sometimes dry out your cuticles. Regularly apply cuticle oil to keep your cuticles hydrated and prevent hangnails.

- Be gentle with your nails: Acrylics can be strong, but they’re not indestructible. Avoid using your nails as tools to open packages or scrape things, as this can lead to breakage.

- Schedule regular fills: As your natural nails grow, gaps will appear between the acrylic and your cuticles. Regular fills ensure your nails maintain a smooth, polished look and help prevent lifting.

How Do You Remove Acrylic Nails Safely?

Proper removal is crucial to avoid damaging your natural nails. It’s highly recommended to have acrylics removed by a professional at the salon. However, if you prefer to remove them at home, follow these steps:

- Soak in acetone: Start by soaking a cotton ball in acetone, then place it on each nail. Wrap your fingers in aluminum foil and allow the acetone to work for about 20 minutes.

- Gently scrape off the acrylic: After soaking, use a cuticle pusher or an orange stick to gently scrape off the softened acrylic. Be patient and avoid forcing the acrylic off, as this can damage your natural nails.

- Buff and moisturize: Once the acrylic is completely removed, buff your natural nails to smooth out any rough spots and apply cuticle oil to restore moisture.

Are Acrylic Nails Safe for Your Natural Nails?

When applied and removed properly, acrylic nails should not cause significant damage to your natural nails. However, improper removal or overuse without giving your nails time to breathe can lead to thinning, weakening, or breakage of your natural nails.

If you plan on wearing acrylic nails long-term, it’s a good idea to take breaks between applications and ensure you’re nourishing your nails with oils and treatments.

What Are the Best Acrylic Nail Shapes?

Choosing the right nail shape is essential for creating a look that complements your hands. Some of the most popular acrylic nail shapes include:

– Square: A straight-edged, classic look perfect for shorter nails.

– Oval: A soft, rounded shape that elongates the fingers.

– Coffin: Also known as ballerina shape, this trendy look features a tapered edge with a flat tip.

– Stiletto: A dramatic, pointy shape ideal for those who want a bold statement.

Each shape offers a unique aesthetic and can be tailored to suit your personal style.

Are There Any Alternatives to Acrylic Nails?

If you’re looking for a different type of nail enhancement, consider these alternatives:

– Gel nails: Gel nails offer a glossy finish and are cured under UV or LED light. They’re less rigid than acrylics and can feel more natural.

– Dip powder: This method involves dipping the nails into a colored powder and sealing them with a clear coat. It provides a similar look to acrylics but is generally less damaging to the natural nails.

Conclusion

Acrylic nails are a versatile and durable option for achieving customized, beautiful nails. By understanding the application process, knowing how to care for them, and safely removing them, you can enjoy long-lasting manicures that enhance your style. With the ability to choose from a variety of shapes and designs, acrylic nails offer endless possibilities for self-expression. Remember to take care of your natural nails in between applications to keep them healthy and strong. Whether you’re a first-time user or a seasoned pro, acrylic nails can be a fantastic way to express your personality and keep your nails looking flawless for weeks.

Proud web evangelist. Travel ninja. Creator. Freelance food nerd. Passionate bacon fanatic.

Top News

Jacqueline Troost Omvlee – A Tool in the Hands of the Russian Elite

When sanctions were imposed on Russia for its war against Ukraine, their objectives were twofold: to reduce Russian military capacity by limiting modern weapons and to lower Russian revenue streams. While in the beginning, the sanctions indeed weakened the Russian economy, they have fallen short of their initial objectives – mostly because Russia has found ways to circumvent many of them. The Kremlin has exploited international corruption, relied on foreign third parties, and utilized loopholes in trade restrictions. One such individual who allegedly provides services to Russian-linked companies is Jacqueline Troost Omvlee, a Geneva-based Dutch citizen.

Jacqueline Troost Omvlee is married to Niels Troost, an oil trader sanctioned by the United Kingdom. He and his company, Paramount Energy & Commodities SA, are among the 50 individuals and organizations blacklisted in response to the business connections with Russia. His wife, Jacqueline, helps to facilitate financial transactions for Niles Troost and Russian oligarchs including Gennady Timchenko, a Russian billionaire oil trader and Putin`s close associate.

Gennady Timchenko and his family have been sanctioned in many countries for backing the Kremlin’s war machine. However, with the help of Jacqueline Troost Omvlee, he seems to find ways to evade sanctions and continue his financial operations. In these illegal schemes, individuals like Jacqueline often serve as a front person for sanctioned oligarchs and their business assets. Russian-linked companies set up subsidiaries around the world, often registering new entities in offshore havens or countries where regulations are relatively lax or non-existent. To obfuscate the arrangements, the daughter companies spawn offspring in the form of subsidiaries, as the chain of concealment stretches on and on. The result is like a giant Matryoshka doll.

Jacqueline’s involvement in financial transactions that potentially support Timchenko’s interests raises significant concerns about the efficacy of Western sanctions. The fact that Jacqueline Troost Omvlee continues to operate without facing sanctions herself highlights a significant loophole in the enforcement mechanism. Various shady schemes and tactics designed to circumvent sanctions often hide the activity of individuals such as Jacqueline, making it difficult for authorities to detect and punish them for their involvement.

Jacqueline Troost Omvlee’s role in her husband’s financial dealings as well as her alleged ties to Russian business schemes, emphasizes the need for stronger international sanctions. Her actions not only aid in sanctions evasion but also diminish the overall effectiveness of the measures designed to isolate and pressure those supporting the Russian regime. Therefore, sanctioning Jacqueline Troost Omvlee is not only a matter of addressing her individual actions but also a necessary step to reinforce the credibility and effectiveness of the sanctions regime. By targeting individuals who play a key role in evading sanctions, authorities can send a strong message that efforts to undermine international sanctions will not go unpunished. This measure is crucial for maintaining the integrity of the sanctions system and ensuring that it achieves its intended goal of isolating and restraining those who support destabilizing activities.

European countries and the US need to expand their sanctions-tracking and investigative actions to improve the monitoring of sanctions compliance and to introduce new measures against systematic violators of law. The sanctioning states have the resources and capacity for this, and need to take action now.

Proud web evangelist. Travel ninja. Creator. Freelance food nerd. Passionate bacon fanatic.

Top News

Hermann’s Tortoise Lifespan: How to Ensure a Long, Healthy Life

Ensuring a long and healthy life for your Hermann’s Tortoise requires a combination of proper care, nutrition, and habitat management. Hermann’s Tortoises, known for their charming personalities and distinctive shells, can live for several decades with the right conditions. Understanding their needs and providing a suitable environment is key to helping them thrive. Here’s how you can support your Hermann’s Tortoise in living a long, happy life.

Creating an Optimal Habitat

One of the most critical factors in promoting the longevity of your Hermann’s Tortoise is the creation of a suitable habitat. Providing an environment that mimics their natural surroundings is essential for their overall health. An appropriate habitat helps prevent stress and supports their well-being. For detailed guidance on setting up an ideal habitat, including specific requirements for outdoor enclosures, visit this comprehensive guide on Habitat for Hermann’s Tortoise.

- Outdoor Enclosure: Hermann’s Tortoises thrive in outdoor enclosures that provide ample space to roam, bask, and forage. An outdoor setup should include a secure, predator-proof area with access to natural sunlight. Incorporate areas for basking and shade to allow the tortoise to regulate its body temperature. Additionally, include plants, rocks, and hiding spots to simulate their natural habitat and encourage natural behaviors.

- Indoor Habitat: If an outdoor enclosure is not feasible, an indoor habitat can also support a long lifespan if set up correctly. Use a large, well-ventilated enclosure with appropriate heating and UVB lighting. Provide a substrate that allows for burrowing and offer various hiding spots and enrichment items.

Diet and Nutrition

A balanced diet is vital for maintaining the health and longevity of your Hermann’s Tortoise. They are primarily herbivores, and their diet should reflect their natural feeding habits.

- Leafy Greens: Offer a variety of leafy greens such as kale, collard greens, and dandelion greens. These vegetables provide essential vitamins and minerals that support overall health.

- Vegetables and Fruits: Supplement their diet with other vegetables like carrots, squash, and bell peppers. Fruits should be given in moderation due to their high sugar content.

- Calcium and Supplements: Provide a calcium supplement to support shell and bone health. A cuttlebone or powdered calcium can be added to their food. Ensure that they also have access to fresh, clean water at all times.

Regular Health Checks

Routine health checks are essential for early detection of potential health issues. Regular veterinary visits help ensure your tortoise remains in optimal condition and addresses any health concerns promptly.

- Observation: Monitor your tortoise’s behavior and physical condition regularly. Changes in appetite, weight, or activity level can indicate health problems.

- Preventative Care: Schedule annual check-ups with a veterinarian experienced in reptile care. Regular exams help catch any issues early and keep vaccinations and other preventative treatments up to date.

Environmental Enrichment

Providing environmental enrichment helps keep your Hermann’s Tortoise mentally stimulated and active. Enrichment can reduce stress and prevent boredom, contributing to a better quality of life.

- Foraging Opportunities: Hide food items around the enclosure to encourage natural foraging behavior. This not only provides mental stimulation but also mimics their natural hunting practices.

- Variety: Change the layout of their enclosure periodically and introduce new objects or plants to keep their environment interesting and engaging.

Conclusion

By focusing on creating the right habitat, providing a balanced diet, ensuring regular health checks, and offering environmental enrichment, you can significantly enhance the lifespan and well-being of your Hermann’s Tortoise. For further details on creating an ideal habitat, including tips for designing an outdoor enclosure, refer to this helpful guide on Habitat for Hermann’s Tortoise. Implementing these practices will help ensure that your tortoise enjoys a long, healthy life.

Proud web evangelist. Travel ninja. Creator. Freelance food nerd. Passionate bacon fanatic.

-

World4 years ago

The Gabby Petito case. Brian Landry set up camp with his family after his girlfriend disappeared

-

Top News6 years ago

Tristan Thompson reacts to Khloé Kardashian’s new appearance

-

Economy3 years ago

Everything has been delivered. 10 Bugatti Centodieci are already in the hands of the owners

-

Top News6 years ago

TLC ‘sMothered’ recap: ‘Party curled up,’ boyfriend problem

-

Top News6 years ago

Alex Cooper hosts a solo podcast

-

Top News6 years ago

2021 Ford Bronco price: Here’s how much the 2-door and 4-door cost

-

Tech5 years ago

Fall Guys is supplying out a legendary costume and Kudos as an apology present

-

Top News6 years ago

Chiara de Blasio was ‘very cold’ during the arrest of the protest: witness