Economy

Hot September in the banking sector with layoffs and strikes

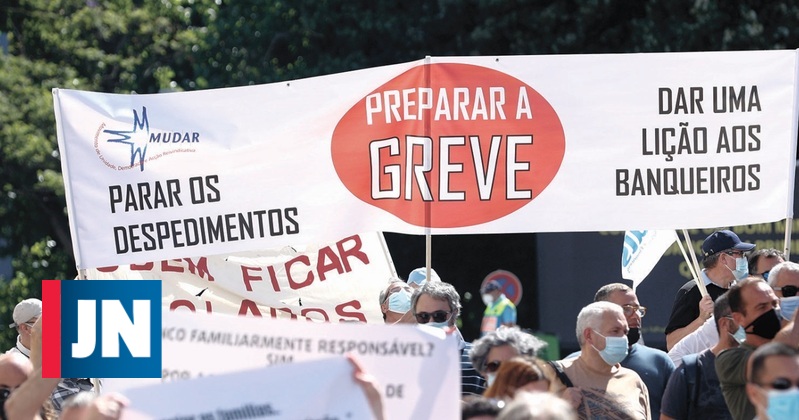

More than 650 bank employees have turned down offers to leave Santander and BCP. Trade unions promise to do everything to stop collective layoffs.

Decisions are still pending, but workers and unions are ready to put more pressure on banks, which have ongoing processes of firing employees. “This is expected to be a very hot end of summer for bank employees,” guarantees Mario Mouran, President of SBN, Portugal’s Financial Sector Workers’ Union. “It is possible that trade unions will ultimately radicalize their actions. And if banks insist on collective layoffs, a strike in this sector is not ruled out, ”he adds.

Behind this competition is one of the biggest redundancies in bank memory. In the second half of this year alone, up to 2,000 bank employees can leave the sector, of which about 1,600 will be fired from Millennium bcp and Santander.

In recent days, the situation in the two large banks with the most ambitious staff reduction processes has changed. After the deadline for employee response to the withdrawal proposals submitted by Santander and BCP, there is already some clarity as to what will happen in each of the banks. In the case of Santander, the bank announced that it intends to begin firing 350 people who refused offers of voluntary dismissal. There is still no official data on BCP, but according to JN / DV, about 300 workers will turn down the submitted quit offers. BCP has already considered moving towards the collective layoff of those who refused to leave in accordance with the restructuring plan.

Strikes in preparation

The announcement of the strikes by the banking unions may occur as early as next week. But so far they have not confirmed what the next protest actions will be.

“Trade unions will not remain indifferent to what is happening. September will undoubtedly be hot, ”confirms Paulo Marcos, President of SNQTB, the National Union of Banking Technicians. “We can guarantee that this is not the end,” he emphasizes in a statement to JN / DV.

Using all possible resources, following the first protest, which for the first time united all unions in the industry, in July, Paulo Marcos and Manuel López of the União dos Sindicatos Independentes were received at an audience with the president last Friday. Republic of Marcelo Rebelo de Sousa.

“We explained to the president that the reductions being carried out are devoid of economic rationality. We are talking about companies with foreign shareholders, very profitable, which impose the dismissal of workers, ”promotes Paulo Marcos. And he stresses that “the large systems companies that are leaving – such as Altice, Santander and BCP – belong to sectors that have not been hit by the crisis” caused by the pandemic.

From an audience with Marcelo Rebelo de Sousa, union members expressed hope that the PR would accept concerns about the major dismissal processes taking place. “The political issue has not yet been resolved,” says the president of SNQTB.

Despite this, the trade unions promise not to wait for help from the government or the Assembly of the Republic and are preparing to roll up their sleeves. On the table are strikes, protests and provocative actions. “Next week we will have meetings to review the situation. We will not accept a collective dismissal, ”emphasizes Mario Mouran from SBN.

Due to the delay in the administration of justice, in order to exclude the possibility of going to court, bankers threaten to use other weapons. Including the strike.

Harassment and pressure

Trade unions and workers’ committees accuse banks of pressuring workers and using harassment to get them to agree to proposals to leave institutions. Bankers deny the charges.

a thousand refused to exit

The bank, led by Pedro Castro and Almeida, will cut 350 seats from more than 700 people who refused offers to leave. At Miguel Maya’s BCP, 300 people will say no.

“Internet specialist. Evil entrepreneur. Troublemaker. Analyst. Tv aficionado. Thinker. Passionate explorer. Bacon guru.”

Economy

What factors impact financial markets?

The global financial markets are now hugely complex, with traders and analysts around the world looking closely for signs of movement. What are some of the most important factors to be aware of that impact the financial markets?

Geopolitical events

With news breaking from different countries throughout the day, many different stories could affect the markets on any given day. For instance, economic indicators such as the European Central Bank’s inflation rates and gross domestic product numbers released by each country can determine which direction the markets take. Stocks, currencies and other financial instruments can all vary depending on these areas.

Major events such as war breaking out, natural disasters and elections also have an effect. When we look at the commodities market, climate change is an issue to bear in mind, with unusual weather sometimes causing scarcity or abundance of a certain product.

An interesting aspect of the modern financial world is the way that the different markets are linked. This means that any important event or news story that affects one area could easily affect another, even if the link isn’t obvious at first sight. We can also see how local shocks and events can quickly have an effect at a global level.

The financial crisis of 2008 is a good example, as it started with a serious downturn in the US housing market. Although this appeared to be a localized issue at first, it soon revealed some major issues with the global banking setup that caused problems around the planet affecting millions of people and diverse industries.

Speculation and investment trends

The previous factors all point toward the markets changing, and there’s no shortage of traders around the world waiting to see what happens next and how they can benefit. This means that we need to take into account other issues such as speculation and investment trends in the markets.

Armed with a variety of tools, including candlestick charts, traders try to identify trends such as support and resistance levels. They use the information they glean from the charts to make their moves, which can influence the general market if enough people make the same moves or if the amounts involved are significant.

Once an investment trend begins, it can have a knock-on effect that would have been impossible to predict at the outset. The example of Bitcoin and other cryptocurrencies shows how something that starts small can grow impressively. Cryptocurrencies have now gained enough mainstream appeal to influence and disrupt many industries, from healthcare to gaming and banking.

It’s important to understand how the leaders of a company operate and how they have faced challenges in the past. If we look at banking and the Bank of New York Mellon in particular, we can see that its history can be traced back to 1784, so it has overcome all the major events that have occurred since then. With some of the biggest names in the business world making up its key institutional investors, this is a company that we would expect to react effectively to changing markets.

Regulatory changes and company results

Just about every industry represented in the financial markets has laws and regulations that govern it. This means that the fear of harsher new laws is an almost constant threat. Meanwhile, the hope that beneficial changes to the regulations help businesses prosper is the other side of this matter that investors keep a close eye on.

Let’s not forget the role played by the profit and loss results produced by major companies. It’s clear that these results have an almost immediate effect on their stock prices. However, we should also bear in mind that this effect can reach other areas of the economy. A surprising set of results for a large business can produce shock waves that travel around the market.

What impact do they cause?

From the wide variety of examples that we’ve looked at here, it’s clear that the impact isn’t going to be the same in every case. While one set of circumstances might snowball and cause a huge impact, another might cause a limited impact before the news disappears as other events overtake it.

Having said that, one of the key issues that they cause is a higher degree of market volatility. We can see how this works by looking at an area such as the COVID-19 pandemic in 2020. The markets became a lot more volatile as the different aspects of the pandemic became clear. Streaming companies, healthcare companies and video conferencing technology firms made huge profits, while airlines and hotels were among those to lose out massively.

Working out the overall impact of a particular situation is almost impossible to do now. With so many traders looking over the latest news stories and numbers with advanced tools, the original impact can quickly grow or simply disappear. Therefore, the key for investors is to understand emerging trends and react to them before it’s too late.

These details reveal how complex the global financial market is now. It’s a fascinating world, and with more information at our fingertips than ever before, it’s something that anyone can start to research and understand in their own way.

Proud web evangelist. Travel ninja. Creator. Freelance food nerd. Passionate bacon fanatic.

Economy

Everything has been delivered. 10 Bugatti Centodieci are already in the hands of the owners

OAll Bugatti Centodieci have been delivered, the Molsheim-based brand said on Monday. Cristiano Ronaldo received the number 07 in October this year. and Bugatti has now revealed that the latest unit – #10 – is already in the possession of its owner.

“The Centodieci combines all the values of the Bugatti brand in an extraordinary package: rarity, innovation, heritage, craftsmanship and unrivaled performance. The production batch of 10 units was so in demand by our customers that it was sold before the Centodieci. was even officially presented,” said Christophe Piochon, president of Bugatti.

This latest example is finished in Quartz White with carbon fiber trim on the bottom and matte grilles. The brake calipers are painted in Light Blue Sport, as is the logo on the rear that refers to the EB110, the iconic Bugatti model that inspired this Centodieci. Inside, the predominant color is also blue, as you can see in the images above.

This block is powered by the same block as the other nine instances. The 8.0-liter W16 with four turbines is capable of developing 1600 hp. In terms of performance, this allows the Centodieci to hit 100 km/h in just 2.4 seconds and reach a top speed of 380 km/h.

Recall that each unit costs the owners eight million euros before taxes.

Read also: We already know when the Bugatti Centodieci fell into the hands of Ronaldo.

Always be the first to know.

Sixth year in a row Consumer Choice and Five Star Online Press Award.

Download our free app.

“Internet specialist. Evil entrepreneur. Troublemaker. Analyst. Tv aficionado. Thinker. Passionate explorer. Bacon guru.”

Economy

The first Dacia hybrid. “The cheapest hybrid family on the market”

BUT Dacia revealed this Monday that the hybrid engine has been available since March on the Jogger, the Romanian brand’s model known to be available with a seven-seat variant.

The Jogger Hybrid 140, Dacia’s first hybrid, will hit dealerships in March, but customers can expect and order it as early as January.

The price has been revealed by Dacia and since it’s only available in the seven-seater SL Extreme, it starts at €28,800. The brand claims it is “the most affordable hybrid family car on the market.”

Available in six existing colors to celebrate the launch of this hybrid, there will be a slate gray version, as you can see in the images above.

Equipped with a 1.6 liter four-cylinder petrol engine with 90 hp, the Jogger is also powered by two electric motors (a 50 hp engine and a high-voltage starter-generator). The total power is 140 horsepower. The electric transmission is automatic, four-speed, connected to an internal combustion engine, and two speeds are connected to an electric motor. This combined technology was possible, according to Dacia, only due to the lack of clutch.

Combined with the energy recovery levels of the 1.2kWh (230V) battery pack and the efficiency of the automatic transmission, regenerative braking delivers all-electric traction on 80% of urban journeys and saves up to 40% of fuel compared to a combustion engine vehicle.

Read also: Dual-fuel Dacia Jogger Eco-G. We tried 5 seater and LPG…

Always be the first to know.

Sixth year in a row Consumer Choice and Five Star Online Press Award.

Download our free app.

“Internet specialist. Evil entrepreneur. Troublemaker. Analyst. Tv aficionado. Thinker. Passionate explorer. Bacon guru.”

-

World4 years ago

The Gabby Petito case. Brian Landry set up camp with his family after his girlfriend disappeared

-

Top News6 years ago

Tristan Thompson reacts to Khloé Kardashian’s new appearance

-

Economy3 years ago

Everything has been delivered. 10 Bugatti Centodieci are already in the hands of the owners

-

Top News6 years ago

TLC ‘sMothered’ recap: ‘Party curled up,’ boyfriend problem

-

Top News6 years ago

Alex Cooper hosts a solo podcast

-

Top News6 years ago

2021 Ford Bronco price: Here’s how much the 2-door and 4-door cost

-

Tech5 years ago

Fall Guys is supplying out a legendary costume and Kudos as an apology present

-

Top News6 years ago

Chiara de Blasio was ‘very cold’ during the arrest of the protest: witness