Economy

Bezos crossed the Pocket line, “where space begins.” Branson didn’t. 10 Minute Ride Records – Observer

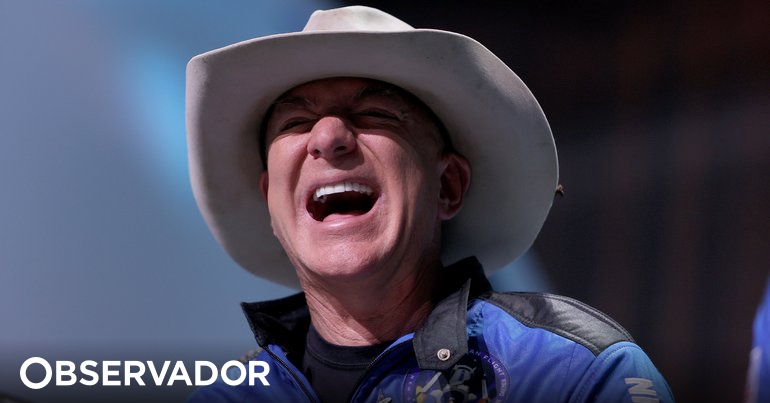

Jeff Bezos flew out of Texas on a rocket, flew into space inside the capsule for four minutes, saw the Earth’s curvature, and returned to touch Earth ten minutes later, at a moment that was apotheosis by friends, family and Blue Origin members. records that will go down in the history of space exploration. One of them was exactly the height at which he arrived, which, unlike what happened to Richard Branson, leaves no doubt that he reached space.

The New Shepard rocket was the first rocket to go into space with a fully civilian crew and was remotely controlled by the Blue Origin team. In addition, Bezos managed to overcome 86 kilometers in height (and this only from the point of view of the American authorities means reaching space). The Bezos rocket traveled 100 kilometers, crossed the Karman line.

But this Tuesday, there was more recording of the trip: aboard the capsule, which he took with him, in addition to his brother Mark, Wally Funk and Oliver Oliver Daman, who at the age of 82 and 18, respectively, became the eldest and the youngest. man of history reaches space.

Tuesday’s trip was awaited with high expectations, not only because of the risks associated with suborbital travel, but also because of the emotion and adrenaline that a trip to space generates, making the moment broadcast live worldwide. Thousands of people are placed on screens in four corners of the world, everything went according to plan and four space tourists were able to experience weightlessness in space and see the beauty of the curvature of the planet.

At the end of the trip, Jeff Bezos confessed that he was fascinated by the “beauty and fragility” of the Earth from space, a trip from which expectations were high, but still “exceeded.” And because Bezos believes the future is through space, the billionaire has pledged to make space travel more accessible to everyone.

After spending hundreds of millions of dollars over the past 20 years and 15 successful tests (without passengers) of the New Shepard rocket named after Alan Shepard, the first American to reach space, on July 20, 1969. Exactly 52 years ago, Blue Origin decided to take the next step and send people to space.

Never gets old! Third landing in a row for this booster. #NSFirstHumanFlight pic.twitter.com/E26ZJW9vd0

– Blue origin (@blueorigin) Jul 20, 2021

Also, to fly, New Shepard doesn’t need a pilot on board, since the whole process is controlled remotely, through a team from Blue Origin, which controls all steps from computers. In the case of Virgin Galactic, space travel requires the presence of a pilot inside the ship – besides Richard Branson, remember two pilots and three other members of the company crew flew – and the journey, which was nine days ago, took about an hour, since the rocket plane was delivered by the base ship before takeoff, and this process took about 45 minutes.

Nice launch from West Texas this morning. #NSFirstHumanFlight pic.twitter.com/JUpRA7PHvv

– Blue origin (@blueorigin) Jul 20, 2021

12 minutes late and after all safety checks before departure New Shepard departed Texas at 2:12 pm and reached three times the speed of sound.… Two minutes after takeoff, the passenger compartment separated from the rocket, and the crew experienced a feeling of weightlessness for about four minutes – they unfastened their seat belts, swam, went to the window and peered into the curvature. From the ground between moments of fun captured on video.

“Who Wants Pins?”: New footage from the capsule shows Jeff Bezos, Mark Bezos, Wally Funk and Oliver Daman spending time in space. https://t.co/5C820HM4EM pic.twitter.com/excCMRm1Zg

– CBS News (@CBSNews) Jul 20, 2021

After that, when New Shepard was already quickly descending towards Texas, where it would land vertically, the capsule descended, gradually slowing down, especially after three parachutes were involved. The landing at 14:22 was successful., completing the journey and starting the celebrations – the first unmanned flight with a fully civilian crew was successfully completed.

Imagine the perfect landing in the West Texas desert! #NSFirstHumanFlight pic.twitter.com/UXQvzBkq6P

– Blue origin (@blueorigin) Jul 20, 2021

But Bezos’ journey into space did not go down in history just because it climbed higher, because the crew chosen by the owner of Blue Origin was not accidental. Jeff Bezos not only invited his younger brother Mark Bezos, but also insisted on being present during his first flight into space. Wally Funk, a pilot who, since the 1960s, dreamed of becoming an astronaut.

Wally Funk travels into space aboard Jeff Bezo’s rocket. But what does this big step mean?

Despite being a National Transportation Safety Board (NTSB) flight safety inspector and a Federal Aviation Administration (FAA) inspector, a pilot since 19 years old and trained over 3,000 people to fly, Wally Funk never had the opportunity to go into space. … He came close to this when he participated in NASA’s astronaut training program, but, since she is a woman, she was not allowed to become an astronaut and go into space…

“Internet specialist. Evil entrepreneur. Troublemaker. Analyst. Tv aficionado. Thinker. Passionate explorer. Bacon guru.”

Economy

What factors impact financial markets?

The global financial markets are now hugely complex, with traders and analysts around the world looking closely for signs of movement. What are some of the most important factors to be aware of that impact the financial markets?

Geopolitical events

With news breaking from different countries throughout the day, many different stories could affect the markets on any given day. For instance, economic indicators such as the European Central Bank’s inflation rates and gross domestic product numbers released by each country can determine which direction the markets take. Stocks, currencies and other financial instruments can all vary depending on these areas.

Major events such as war breaking out, natural disasters and elections also have an effect. When we look at the commodities market, climate change is an issue to bear in mind, with unusual weather sometimes causing scarcity or abundance of a certain product.

An interesting aspect of the modern financial world is the way that the different markets are linked. This means that any important event or news story that affects one area could easily affect another, even if the link isn’t obvious at first sight. We can also see how local shocks and events can quickly have an effect at a global level.

The financial crisis of 2008 is a good example, as it started with a serious downturn in the US housing market. Although this appeared to be a localized issue at first, it soon revealed some major issues with the global banking setup that caused problems around the planet affecting millions of people and diverse industries.

Speculation and investment trends

The previous factors all point toward the markets changing, and there’s no shortage of traders around the world waiting to see what happens next and how they can benefit. This means that we need to take into account other issues such as speculation and investment trends in the markets.

Armed with a variety of tools, including candlestick charts, traders try to identify trends such as support and resistance levels. They use the information they glean from the charts to make their moves, which can influence the general market if enough people make the same moves or if the amounts involved are significant.

Once an investment trend begins, it can have a knock-on effect that would have been impossible to predict at the outset. The example of Bitcoin and other cryptocurrencies shows how something that starts small can grow impressively. Cryptocurrencies have now gained enough mainstream appeal to influence and disrupt many industries, from healthcare to gaming and banking.

It’s important to understand how the leaders of a company operate and how they have faced challenges in the past. If we look at banking and the Bank of New York Mellon in particular, we can see that its history can be traced back to 1784, so it has overcome all the major events that have occurred since then. With some of the biggest names in the business world making up its key institutional investors, this is a company that we would expect to react effectively to changing markets.

Regulatory changes and company results

Just about every industry represented in the financial markets has laws and regulations that govern it. This means that the fear of harsher new laws is an almost constant threat. Meanwhile, the hope that beneficial changes to the regulations help businesses prosper is the other side of this matter that investors keep a close eye on.

Let’s not forget the role played by the profit and loss results produced by major companies. It’s clear that these results have an almost immediate effect on their stock prices. However, we should also bear in mind that this effect can reach other areas of the economy. A surprising set of results for a large business can produce shock waves that travel around the market.

What impact do they cause?

From the wide variety of examples that we’ve looked at here, it’s clear that the impact isn’t going to be the same in every case. While one set of circumstances might snowball and cause a huge impact, another might cause a limited impact before the news disappears as other events overtake it.

Having said that, one of the key issues that they cause is a higher degree of market volatility. We can see how this works by looking at an area such as the COVID-19 pandemic in 2020. The markets became a lot more volatile as the different aspects of the pandemic became clear. Streaming companies, healthcare companies and video conferencing technology firms made huge profits, while airlines and hotels were among those to lose out massively.

Working out the overall impact of a particular situation is almost impossible to do now. With so many traders looking over the latest news stories and numbers with advanced tools, the original impact can quickly grow or simply disappear. Therefore, the key for investors is to understand emerging trends and react to them before it’s too late.

These details reveal how complex the global financial market is now. It’s a fascinating world, and with more information at our fingertips than ever before, it’s something that anyone can start to research and understand in their own way.

Proud web evangelist. Travel ninja. Creator. Freelance food nerd. Passionate bacon fanatic.

Economy

Everything has been delivered. 10 Bugatti Centodieci are already in the hands of the owners

OAll Bugatti Centodieci have been delivered, the Molsheim-based brand said on Monday. Cristiano Ronaldo received the number 07 in October this year. and Bugatti has now revealed that the latest unit – #10 – is already in the possession of its owner.

“The Centodieci combines all the values of the Bugatti brand in an extraordinary package: rarity, innovation, heritage, craftsmanship and unrivaled performance. The production batch of 10 units was so in demand by our customers that it was sold before the Centodieci. was even officially presented,” said Christophe Piochon, president of Bugatti.

This latest example is finished in Quartz White with carbon fiber trim on the bottom and matte grilles. The brake calipers are painted in Light Blue Sport, as is the logo on the rear that refers to the EB110, the iconic Bugatti model that inspired this Centodieci. Inside, the predominant color is also blue, as you can see in the images above.

This block is powered by the same block as the other nine instances. The 8.0-liter W16 with four turbines is capable of developing 1600 hp. In terms of performance, this allows the Centodieci to hit 100 km/h in just 2.4 seconds and reach a top speed of 380 km/h.

Recall that each unit costs the owners eight million euros before taxes.

Read also: We already know when the Bugatti Centodieci fell into the hands of Ronaldo.

Always be the first to know.

Sixth year in a row Consumer Choice and Five Star Online Press Award.

Download our free app.

“Internet specialist. Evil entrepreneur. Troublemaker. Analyst. Tv aficionado. Thinker. Passionate explorer. Bacon guru.”

Economy

The first Dacia hybrid. “The cheapest hybrid family on the market”

BUT Dacia revealed this Monday that the hybrid engine has been available since March on the Jogger, the Romanian brand’s model known to be available with a seven-seat variant.

The Jogger Hybrid 140, Dacia’s first hybrid, will hit dealerships in March, but customers can expect and order it as early as January.

The price has been revealed by Dacia and since it’s only available in the seven-seater SL Extreme, it starts at €28,800. The brand claims it is “the most affordable hybrid family car on the market.”

Available in six existing colors to celebrate the launch of this hybrid, there will be a slate gray version, as you can see in the images above.

Equipped with a 1.6 liter four-cylinder petrol engine with 90 hp, the Jogger is also powered by two electric motors (a 50 hp engine and a high-voltage starter-generator). The total power is 140 horsepower. The electric transmission is automatic, four-speed, connected to an internal combustion engine, and two speeds are connected to an electric motor. This combined technology was possible, according to Dacia, only due to the lack of clutch.

Combined with the energy recovery levels of the 1.2kWh (230V) battery pack and the efficiency of the automatic transmission, regenerative braking delivers all-electric traction on 80% of urban journeys and saves up to 40% of fuel compared to a combustion engine vehicle.

Read also: Dual-fuel Dacia Jogger Eco-G. We tried 5 seater and LPG…

Always be the first to know.

Sixth year in a row Consumer Choice and Five Star Online Press Award.

Download our free app.

“Internet specialist. Evil entrepreneur. Troublemaker. Analyst. Tv aficionado. Thinker. Passionate explorer. Bacon guru.”

-

World4 years ago

The Gabby Petito case. Brian Landry set up camp with his family after his girlfriend disappeared

-

Top News6 years ago

Tristan Thompson reacts to Khloé Kardashian’s new appearance

-

Economy3 years ago

Everything has been delivered. 10 Bugatti Centodieci are already in the hands of the owners

-

Top News6 years ago

TLC ‘sMothered’ recap: ‘Party curled up,’ boyfriend problem

-

Top News6 years ago

Alex Cooper hosts a solo podcast

-

Top News6 years ago

2021 Ford Bronco price: Here’s how much the 2-door and 4-door cost

-

Tech5 years ago

Fall Guys is supplying out a legendary costume and Kudos as an apology present

-

Top News6 years ago

Chiara de Blasio was ‘very cold’ during the arrest of the protest: witness