Economy

And when interest rates rise?

Total home loans increased by 4.8% in April to 98.3 billion euros compared to the same period in 2021. This is a similar increase recorded in March, the Bank of Portugal (BdP) said. After all, financial institutions gave 3.3 million euros a day only for real estate acquisition transactions, not yet reflecting the restrictions imposed by the regulator.

The Bank of Portugal introduced new restrictions on the maximum repayment period for new mortgage loans from April, depending on age.

For customers older than 35 years, the loan repayment period should not exceed 35 years. For bank customers older than 30 years and younger than 35 years, the maximum loan term should be 37 years. Loans up to 40 years old are now possible for those less than or equal to 30 years old.

However, analysts contacted by Sunrise admit that this impact is not yet noticeable. “Housing lending remains strong, but recent restrictions are not expected to have a major impact on this trend. On the other hand, these new measures may encourage young people to use home loans earlier,” says XTB’s Enrique Tome.

Nuno Garcia, CEO of GesConsult, admits that since the announcement of the restrictions we have seen a “credit rush”, which is why the maximum loan amounts were reached in March since 2007. Going forward, he believes, “these restrictions may have an impact on home buying as the time frame gets progressively shorter,” adding that “this is a situation that deserves attention, especially as we see conditions for buying a home coming later and later.” “.

an alarm sounds

The alarm is sounded not only by those who have already purchased housing, but also by those who had a mortgage loan. The explanation is simple: in recent months, the European Central Bank has shrugged off interest rate hikes, moving away from the current negative-interest-rate scenario that harms savings but benefits bank house payers.

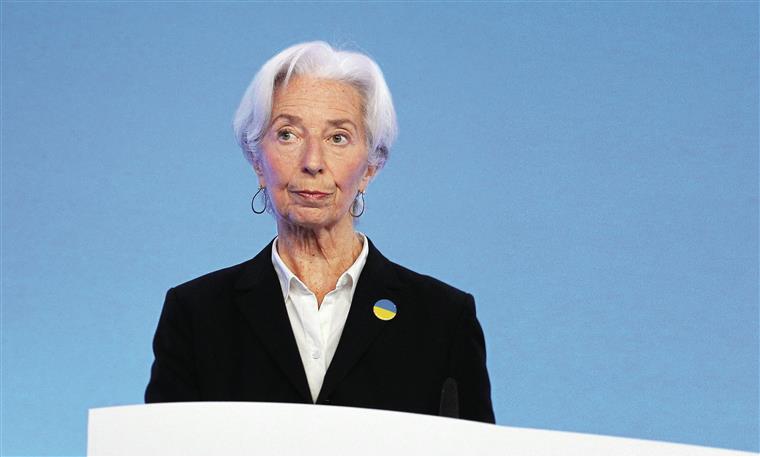

And Christine Lagarde already admitted this week that a simple “gradual” approach to the pace of interest rate hikes may not be enough to reduce inflation risks.

The central bank’s idea is to stop buying debt in the third quarter, allowing interest rates to rise for the first time in July, and current ECB expectations are that there will be no more interest rates in the euro area by the end of the third quarter. – reference to the interest rate on deposits, which is at the level of -0.5%.

Enrique Tomé says that in Portugal the real estate market problem is mainly due to the fact that with such a large demand for real estate, there are few offers. But he acknowledges that “in the short term, higher interest rates could effectively dampen demand in the real estate market, which could lead to a slight price correction,” adding that “concerns about a possible economic downturn could also fuel this scenario of real estate price correction.”

However, the XTB analyst is optimistic and recalls that interest rates have been at their lowest for several years, believing that, despite the start of growth, this increase will be gradual and should not greatly affect families. “In fact, compared to what is happening in the US, the ECB takes a much more cautious position, but in fact there is such a possibility. We are seeing a slowdown in growth in several sectors, with the exception of the real estate sector, which remains stable.”

But he points to risks, saying that factors that could contribute to a slowdown in the sector are beginning to emerge, such as rising interest rates and medium- and long-term risks that point to a possible slowdown in economic growth.

More pessimistic is Nuno Garcia, for whom the increase in interest rates entails an increase in monthly housing costs, including monthly loan payments. “For families, this can be difficult to overcome because paying electricity, water and gas bills has often already been a problem, with an increase in the monthly loan payment, the situation worsens.”

And given this scenario, the official advises buyers to analyze the situation well and see if they can guarantee the payment of their expenses, “so that we do not repeat what happened in 2011, when loans were stopped due to payment.”

Despite these risks, the general director of GesConsult believes that now they will be less than those that were observed during the Troika. And he explains why: “Today we see more rules in home loan approval and people are more informed about the whole process. I don’t think we’re going to go through the same situation. However, you must be especially careful, no doubt. We emerge from one crisis and enter another almost instantly. It takes the ability to adapt and reflect so we don’t go through the same thing again.”

point solutions

If, on the one hand, Nuno Garcia says that the rental market can be seen as an opportunity and as a faster solution for the market, Enrique Tomé advises those who are preparing to buy a house in the coming months to negotiate good prices in order not to pay an excessive amount for an excessive overpriced and speculative real estate.

In an interview with i newspaper, Natalia Nunez, who is in charge of the Deco Financial Protection Authority, has already acknowledged that the decision to raise interest rates will inevitably affect those with mortgages and that it could get new contours for consumers who are at the limit of payments on mortgage loans. your expenses.

In this regard, we must now count on rising prices for fuel, energy, food, transport, etc., as well as on rising inflation. “This is a concern that we have had since the beginning of the year. We have warned consumers to consider the household budget in case they are faced with a change in interest rates, as this may have some impact on the amount of the payment due to the bank at the end of the month.”

An even bigger headache for those who, according to the person in charge, already have a high rate of effort. “It’s not just a question of raising the interest rate, it’s all that we already feel every day, it’s the rise in prices, what’s been happening since the beginning of the year. Most families reach the end of the month and end up spending much more than before, and their income has not kept pace with the increase in these expenses,” says Natalia Nunez.

“Internet specialist. Evil entrepreneur. Troublemaker. Analyst. Tv aficionado. Thinker. Passionate explorer. Bacon guru.”

Economy

What factors impact financial markets?

The global financial markets are now hugely complex, with traders and analysts around the world looking closely for signs of movement. What are some of the most important factors to be aware of that impact the financial markets?

Geopolitical events

With news breaking from different countries throughout the day, many different stories could affect the markets on any given day. For instance, economic indicators such as the European Central Bank’s inflation rates and gross domestic product numbers released by each country can determine which direction the markets take. Stocks, currencies and other financial instruments can all vary depending on these areas.

Major events such as war breaking out, natural disasters and elections also have an effect. When we look at the commodities market, climate change is an issue to bear in mind, with unusual weather sometimes causing scarcity or abundance of a certain product.

An interesting aspect of the modern financial world is the way that the different markets are linked. This means that any important event or news story that affects one area could easily affect another, even if the link isn’t obvious at first sight. We can also see how local shocks and events can quickly have an effect at a global level.

The financial crisis of 2008 is a good example, as it started with a serious downturn in the US housing market. Although this appeared to be a localized issue at first, it soon revealed some major issues with the global banking setup that caused problems around the planet affecting millions of people and diverse industries.

Speculation and investment trends

The previous factors all point toward the markets changing, and there’s no shortage of traders around the world waiting to see what happens next and how they can benefit. This means that we need to take into account other issues such as speculation and investment trends in the markets.

Armed with a variety of tools, including candlestick charts, traders try to identify trends such as support and resistance levels. They use the information they glean from the charts to make their moves, which can influence the general market if enough people make the same moves or if the amounts involved are significant.

Once an investment trend begins, it can have a knock-on effect that would have been impossible to predict at the outset. The example of Bitcoin and other cryptocurrencies shows how something that starts small can grow impressively. Cryptocurrencies have now gained enough mainstream appeal to influence and disrupt many industries, from healthcare to gaming and banking.

It’s important to understand how the leaders of a company operate and how they have faced challenges in the past. If we look at banking and the Bank of New York Mellon in particular, we can see that its history can be traced back to 1784, so it has overcome all the major events that have occurred since then. With some of the biggest names in the business world making up its key institutional investors, this is a company that we would expect to react effectively to changing markets.

Regulatory changes and company results

Just about every industry represented in the financial markets has laws and regulations that govern it. This means that the fear of harsher new laws is an almost constant threat. Meanwhile, the hope that beneficial changes to the regulations help businesses prosper is the other side of this matter that investors keep a close eye on.

Let’s not forget the role played by the profit and loss results produced by major companies. It’s clear that these results have an almost immediate effect on their stock prices. However, we should also bear in mind that this effect can reach other areas of the economy. A surprising set of results for a large business can produce shock waves that travel around the market.

What impact do they cause?

From the wide variety of examples that we’ve looked at here, it’s clear that the impact isn’t going to be the same in every case. While one set of circumstances might snowball and cause a huge impact, another might cause a limited impact before the news disappears as other events overtake it.

Having said that, one of the key issues that they cause is a higher degree of market volatility. We can see how this works by looking at an area such as the COVID-19 pandemic in 2020. The markets became a lot more volatile as the different aspects of the pandemic became clear. Streaming companies, healthcare companies and video conferencing technology firms made huge profits, while airlines and hotels were among those to lose out massively.

Working out the overall impact of a particular situation is almost impossible to do now. With so many traders looking over the latest news stories and numbers with advanced tools, the original impact can quickly grow or simply disappear. Therefore, the key for investors is to understand emerging trends and react to them before it’s too late.

These details reveal how complex the global financial market is now. It’s a fascinating world, and with more information at our fingertips than ever before, it’s something that anyone can start to research and understand in their own way.

Proud web evangelist. Travel ninja. Creator. Freelance food nerd. Passionate bacon fanatic.

Economy

Everything has been delivered. 10 Bugatti Centodieci are already in the hands of the owners

OAll Bugatti Centodieci have been delivered, the Molsheim-based brand said on Monday. Cristiano Ronaldo received the number 07 in October this year. and Bugatti has now revealed that the latest unit – #10 – is already in the possession of its owner.

“The Centodieci combines all the values of the Bugatti brand in an extraordinary package: rarity, innovation, heritage, craftsmanship and unrivaled performance. The production batch of 10 units was so in demand by our customers that it was sold before the Centodieci. was even officially presented,” said Christophe Piochon, president of Bugatti.

This latest example is finished in Quartz White with carbon fiber trim on the bottom and matte grilles. The brake calipers are painted in Light Blue Sport, as is the logo on the rear that refers to the EB110, the iconic Bugatti model that inspired this Centodieci. Inside, the predominant color is also blue, as you can see in the images above.

This block is powered by the same block as the other nine instances. The 8.0-liter W16 with four turbines is capable of developing 1600 hp. In terms of performance, this allows the Centodieci to hit 100 km/h in just 2.4 seconds and reach a top speed of 380 km/h.

Recall that each unit costs the owners eight million euros before taxes.

Read also: We already know when the Bugatti Centodieci fell into the hands of Ronaldo.

Always be the first to know.

Sixth year in a row Consumer Choice and Five Star Online Press Award.

Download our free app.

“Internet specialist. Evil entrepreneur. Troublemaker. Analyst. Tv aficionado. Thinker. Passionate explorer. Bacon guru.”

Economy

The first Dacia hybrid. “The cheapest hybrid family on the market”

BUT Dacia revealed this Monday that the hybrid engine has been available since March on the Jogger, the Romanian brand’s model known to be available with a seven-seat variant.

The Jogger Hybrid 140, Dacia’s first hybrid, will hit dealerships in March, but customers can expect and order it as early as January.

The price has been revealed by Dacia and since it’s only available in the seven-seater SL Extreme, it starts at €28,800. The brand claims it is “the most affordable hybrid family car on the market.”

Available in six existing colors to celebrate the launch of this hybrid, there will be a slate gray version, as you can see in the images above.

Equipped with a 1.6 liter four-cylinder petrol engine with 90 hp, the Jogger is also powered by two electric motors (a 50 hp engine and a high-voltage starter-generator). The total power is 140 horsepower. The electric transmission is automatic, four-speed, connected to an internal combustion engine, and two speeds are connected to an electric motor. This combined technology was possible, according to Dacia, only due to the lack of clutch.

Combined with the energy recovery levels of the 1.2kWh (230V) battery pack and the efficiency of the automatic transmission, regenerative braking delivers all-electric traction on 80% of urban journeys and saves up to 40% of fuel compared to a combustion engine vehicle.

Read also: Dual-fuel Dacia Jogger Eco-G. We tried 5 seater and LPG…

Always be the first to know.

Sixth year in a row Consumer Choice and Five Star Online Press Award.

Download our free app.

“Internet specialist. Evil entrepreneur. Troublemaker. Analyst. Tv aficionado. Thinker. Passionate explorer. Bacon guru.”

-

World4 years ago

The Gabby Petito case. Brian Landry set up camp with his family after his girlfriend disappeared

-

Top News6 years ago

Tristan Thompson reacts to Khloé Kardashian’s new appearance

-

Economy3 years ago

Everything has been delivered. 10 Bugatti Centodieci are already in the hands of the owners

-

Top News6 years ago

TLC ‘sMothered’ recap: ‘Party curled up,’ boyfriend problem

-

Top News6 years ago

Alex Cooper hosts a solo podcast

-

Top News6 years ago

2021 Ford Bronco price: Here’s how much the 2-door and 4-door cost

-

Tech5 years ago

Fall Guys is supplying out a legendary costume and Kudos as an apology present

-

Top News6 years ago

Chiara de Blasio was ‘very cold’ during the arrest of the protest: witness