Politics

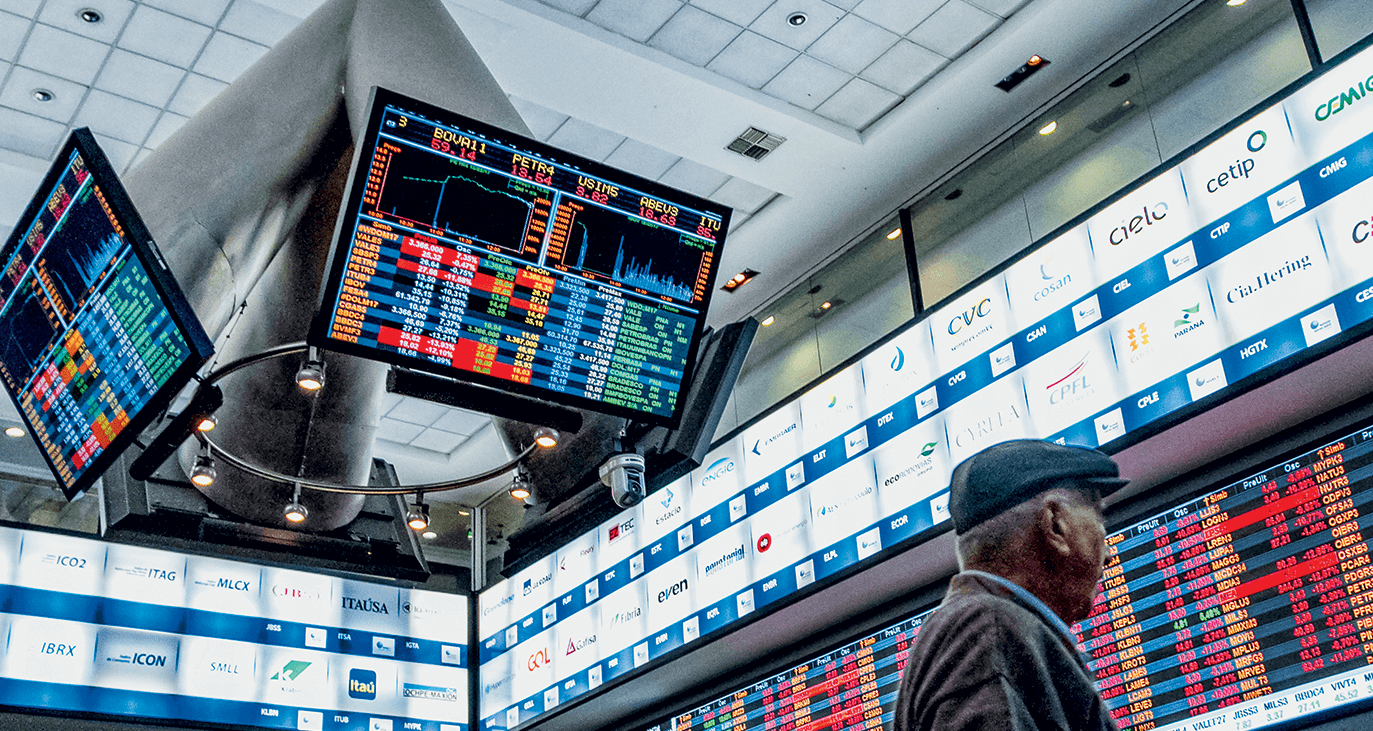

Ibovespa falls by 2.75% and returns to 107 thousand points; the political scenario and dismissals in the Ministry of Economy are not far off

On the day of massive losses, Ibovespa, the main B3 index on Thursday, January 21, closed with a 2.75% drop. 107,735 points with investors are worried about the worsening fiscal situation in the country.

On Ibovespa, the only stocks to close higher were Suzano (SUZB3), which gained 1.47% following the announcement of the expectation of the plan. removing 40 million tonnes of CO2 from the atmosphere by 2025; and the BB Seguridade (BBSE3) papers, which had a slight increase of 0.80%. Klabin blocks (KLBN11) closed stable.

The index’s biggest loss was with Getnet (GETT11), whose units recorded a 19.76% drop since its debut at B3 on Monday.

Among the highlights of the day, the special committee Proposed Constitutional Amendment (PEC) Precatorium the cost ceiling rule has been changed. This change uses a new methodology that takes into account the consumer price index (IPCA) from January to December, rather than the period from June to June.

If the change is approved, the government will be able to increase spending by 8.7%, which is inflation market analysts forecast for this year.

If this larger reserve is added to the increase in the part of the payment of court orders, the budget for 2022 is approximately R $ 83 billion.

It is worth noting that this budget space will be used to finance adjustments to social programs within the spending ceiling.

To make matters worse, the foreign market contributed to the collapse of the Brazilian stock exchange. with concerns about the Chinese real estate sector and rising global inflation.

On wall street The Dow Jones Index closed almost steady, with a slight fall of 0.02% to 35,603 points; S&P 500 rose 0.30% to 4549 points; the Nasdaq index rose 0.62% to 15,215 points.

Economic agenda

There are no indicators on the agenda this Friday, August 22nd. Thus, the focus remains on the political scenario. the resignation of Bruno Funchal, Special Minister of Finance and Budget, and Jefferson Bittencourt, Secretary of the National Treasury, should affect investor sentiment.

The panic in the ministry was even greater when Deputy Special Secretary of the Treasury and Budget Guildenora Dantas and Deputy Secretary of the National Treasury Rafael Araujo left their positions.

According to the portfolio, ministry employees left for personal reasons.

The foreign economic agenda is expected to publish data on various purchasing managers’ indexes (PMI). PMI from Germany, Eurozone and USA will leave.

General internet buff. Hardcore music maven. Typical foodaholic. Friendly student.

Politics

The dollar continues to reflect the political scenario

Yesterday, financial agents evaluated the opposite decision of the Federal Supreme Court (STF) regarding the so-called secret budget. In addition, a decision was made by STF Minister Gilmar Méndez to issue an injunction that would exclude the Bolsa Família from the spending cap rule, with investors trying to understand how this measure would affect the processing of the transitional PEC in the Chamber of Deputies. Oh this PEC!!!!

Since he is an exchange investor, any reading that the budget will be exceeded or become more flexible will negatively affect the exchange market, whether through the PEC or in any other way. We will continue with volatility today.

Looking beyond, the US Central Bank (Fed), although slowing down the pace of monetary tightening at its December meeting, issued a tougher-than-expected statement warning that its fight against inflation was not yet over, raising fears that rising US interest rates will push the world’s largest economy into recession.

The currency market continues to react to political news. The voting on the PEC is saved for today. It is expected that it will indeed be reviewed to open the way tomorrow for discussions on the 2023 budget.

For today on the calendar we will have an index of consumer confidence in the eurozone. Good luck and good luck in business!!

General internet buff. Hardcore music maven. Typical foodaholic. Friendly student.

Politics

Andrés Sánchez consults with the Ministry of Sports, but refuses a political post.

The former president of the Corinthians dreams of working for the CBF as a national team coordinator. He was consulted shortly after Lula’s election.

Former Corinthians president Andrés Sánchez was advised to take a position in the Ministry of Sports under the administration of Lula (PT). However, he ruled out a return to politics. dreams of taking over the coordination of CBF selectionHow do you know PURPOSE.

No formal invitation was made to the former Corinthian representative, only a consultation on a portfolio opportunity with the new federal government, which will be sworn in on January 1, 2023.

Andrés was the Federal MP for São Paulo from 2015 to 2019. At that time he was elected by the Workers’ Party. However, the football manager begs to stay in the sport, ruling out the possibility of getting involved in politics again.

Andrés Sanchez’s desire is to fill the position of CBF tackle coordinator, which should become vacant after the 2022 World Cup. Juninho Paulista fulfills this function in Brazil’s top football institution.

The former president of Corinthians was in Qatar to follow the World Cup along with other figures in Brazilian football. During his time in the country, he strengthened his ties with the top leadership of the CBF.

Editors’ Choice

General internet buff. Hardcore music maven. Typical foodaholic. Friendly student.

Politics

The EU has reached a political agreement on limiting gas prices – 19.12.2022

The agreement was approved by a supermajority at a ministerial meeting of member states in Brussels, Belgium, after months of discussions about the best way to contain the rise in natural gas prices in the bloc caused by Russia’s invasion of Ukraine. .

The value set by the countries is well below the proposal made by the European Commission, the EU’s executive body, in November: 275 EUR/MWh. However, the countries leading the cap campaign were in favor of an even lower limit, around 100 EUR/MWh.

Germany, always wary of price controls, voted in favor of 180 euros, while Austria and the Netherlands, also skeptical of the cap, abstained. Hungary, the most pro-Russian country in the EU, voted against.

The instrument will enter into force on 15 February, but only if natural gas prices on the Amsterdam Stock Exchange exceed 180 euros/MWh for three consecutive days. In addition, the difference compared to a number of global benchmarks should be more than 35 euros.

Italy, the EU’s biggest supporter of the ceiling, has claimed responsibility for the measure. “This is a victory for Italy, which believed and worked for us to reach this agreement,” Environment and Energy Minister Gilberto Picetto tweeted.

“This is a victory for Italian and European citizens who demand energy security,” he added.

Currently, the gas price in Amsterdam is around 110 EUR/MWh, which is already a reflection of the agreement in Brussels – in August the figure even broke the barrier of 340 EUR/MWh.

However, Russia has already threatened to stop exports to countries that adhere to the ceiling. (ANSA).

General internet buff. Hardcore music maven. Typical foodaholic. Friendly student.

-

World4 years ago

The Gabby Petito case. Brian Landry set up camp with his family after his girlfriend disappeared

-

Top News5 years ago

Tristan Thompson reacts to Khloé Kardashian’s new appearance

-

Economy2 years ago

Everything has been delivered. 10 Bugatti Centodieci are already in the hands of the owners

-

Top News5 years ago

TLC ‘sMothered’ recap: ‘Party curled up,’ boyfriend problem

-

Top News5 years ago

Alex Cooper hosts a solo podcast

-

Top News5 years ago

2021 Ford Bronco price: Here’s how much the 2-door and 4-door cost

-

Tech5 years ago

Fall Guys is supplying out a legendary costume and Kudos as an apology present

-

Top News5 years ago

Chiara de Blasio was ‘very cold’ during the arrest of the protest: witness