Yesterday, financial agents evaluated the opposite decision of the Federal Supreme Court (STF) regarding the so-called secret budget. In addition, a decision was made by STF Minister Gilmar Méndez to issue an injunction that would exclude the Bolsa Família from the spending cap rule, with investors trying to understand how this measure would affect the processing of the transitional PEC in the Chamber of Deputies. Oh this PEC!!!!

Since he is an exchange investor, any reading that the budget will be exceeded or become more flexible will negatively affect the exchange market, whether through the PEC or in any other way. We will continue with volatility today.

Looking beyond, the US Central Bank (Fed), although slowing down the pace of monetary tightening at its December meeting, issued a tougher-than-expected statement warning that its fight against inflation was not yet over, raising fears that rising US interest rates will push the world’s largest economy into recession.

The currency market continues to react to political news. The voting on the PEC is saved for today. It is expected that it will indeed be reviewed to open the way tomorrow for discussions on the 2023 budget.

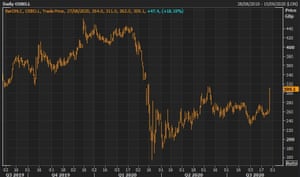

Yesterday, the spot price closed the selling day at R$5.3103.

For today on the calendar we will have an index of consumer confidence in the eurozone. Good luck and good luck in business!!