Economy

House over a million flies logo

The demand for properties over one million euros continues to win over buyers. The number of transactions recorded in the first quarter of the year is already in line with transactions carried out in the years leading up to the pandemic. The guarantee for Nascer do SOL was provided by Patricia Barao, Head of Housing at JLL, stressing that the segment “has grown systematically since 2016, and although it declined in percentage terms last year as a result of the pandemic as a result of the pandemic, in the first quarter. already showing values corresponding to weight in dock years, which demonstrates the resilience of this sector. ” And given this scenario, he has no doubts: “This year we will have one of the best years in history. Demand is strong, the residential market has shown resilience to the test, and it has been an outstanding year in line with pre-covid performance. “

Contrary to what one might expect, local buyers dominate the purchase of this type of property. In the first three months of the year, the national market accounted for more than 80% of the sales made according to the reports of the responsible persons. But given the average sales ratio, the national market has a weight of 60% and the international market 40%. “We are an international consultant, therefore we work very actively with the international market, where we sell real estate to 45 nationalities. Brazilians, French, Chinese and British stand out, ”says Patricia Barao.

But what is the secret of these transactions? The head of Residential JLL explains: “There is a strong demand for specialty properties where there is little supply. Usually these are unique apartments of a new project, penthouses, houses with special elements such as large outdoor areas or private pools, which are of greater demand and the highest values, and where we sometimes have more than one client for the same property. »And our newspaper recognizes that Portugal is increasingly becoming a developing country in Europe in real estate, targeting a more exclusive audience. “The market in which we operate at JLL – medium / high – has been very active and we have sold more properties with higher value than in previous years.”

Consequently, most of the offer is sold before it is completed, that is, at the factory. In fact, one of the specialist consultants. “We believe that the main reason for having potential in plant sales is that at this stage you have growth potential in the purchase. There is a lot of demand and little supply at the plant, so purchases at the plant are of great interest to both local and foreign customers, ”says Patricia Barao.

An opinion shared by the President of the Association of Real Estate Professionals and Intermediaries of Portugal (APEMIP), which ensures that the fact that many projects are sold without completion is due to the confidence of investors, developers and, above all, in the expectation of future value. “There are investors who want to secure the purchase of a project that is still under development, both for new construction and for rehabilitation. In addition, whoever buys the plant wants to have assurances that it is making a good long-term investment, ”says Paulo Cayado in an interview with Nascer do SOL.

But the “secrets” don’t end there. “The premium market is characterized not only by the value of a property unit, but also by the characteristics and services they offer. Whether it is a unique or privileged location, views (river, sea or city), leading architects, high ceilings or finishes exceeding normal standards, amenities for pools, gardens, paddle courts, spas, gyms, areas for children and such services as a security guard and / or concierge, ”adds Patricia Barao (see page 55).

However, the responsible authority acknowledges that the real estate sector was not indifferent to the effects of periods of imprisonment, which, despite all the restrictions that arose as a result, ultimately led to real estate activities. “But almost a year later, the market showed resilience and returned to extraordinary activity in line with 2019 levels.”

“Luxury stands up to the challenge”

Despite admitting that the pandemic has affected the luxury goods market, as some of the clients in this segment are foreigners and therefore their mobility has remained unchanged for a long time, the President of APEMIP acknowledges that “the luxury goods market was governed. to face the challenges, “and recalls that” as soon as the prospect of vaccination appeared, this segment regained its momentum. “Expectations for the future are good because people are still not moving like in 2018 and 2019.”

Paulo Cayado, however, says that there are few offers of properties that are very expensive compared to others, and “it happens that these higher value properties are being taken over by investors.” But he leaves a warning: “This does not mean that the more expensive the property, the faster it is sold.”

For the person in charge, the prospects are encouraging. “I believe that the residential real estate market has shown a positive upward trend in recent months. In the first quarter of 2021, between January and March, home sales were € 6.9 billion, up 2.5% over the same period in 2020. Of this amount, approximately 5.6 billion euros are for existing housing and 1.2 billion euros. billion euros for deals on the new placement ”. And given this scenario, there is no room for doubt: “The trend is that 2021 will continue to be a year of significant growth in the real estate market.”

It is true that the pandemic has left its mark on this market, driven by a slowdown in demand. According to the president of APEMIP, “demand for housing slowed during the initial phase of the pandemic, mainly due to the uncertainty that arose,” but he guarantees that “over the past few months, it has resumed, proving that property values have a very solid component. People thought more about their real housing needs and, as a result, the number of transactions increased. The pandemic has also shown that people are much more choosy before buying a house, ”he says to Nasser do SOL.

Paulo Cayado ensures that “investing in real estate in Portugal is still a good business, especially when looking at the market in the long term.” But let’s move on to the numbers. The official says the vast majority of buyers are Portuguese and, using the latest figures released by INE and analyzed by the APEMIP Research Office, “230,776 properties were sold, indicating that only 19,520 properties (8.5%) were acquired by other persons. -residents.

race to a new job

“There is a great demand for new buildings.” The guarantee for Nascer do SOL was given by Ricardo Sousa, CEO of Century 21 Portugal, and he reminds that “in addition, the purchase of the plant also gives access to progressive payment terms, which are very much appreciated by the Portuguese”. In fact, the official admits that “the Portuguese dominate all segments of the national real estate market,” which “records a very high level of demand.”

According to the official, there is no doubt: “The residential real estate market has shown high resilience to the pandemic, which also caused the need for new housing for the Portuguese. Given the conservative profile of the Portuguese in terms of investment and with the increase in the level of savings of the population, the housing market has become the main option for investment. ”

With regard to the luxury goods market, Ricardo Sousa guarantees that “it has a very specific dynamic, inelastic in relation to short-term dynamics,” while in relation to the traditional market it is determined by low interest rates, excess liquidity in the market and the growth of new mortgage transactions. and the fact that 45% of Portuguese want to change their homes as a result of the pandemic.

“These facts and indicators that we are capturing in the real estate market give us confidence that this trend will continue in 2022, and with the increase in household savings, the housing market has become the main option for investment,” he adds. to our magazine.

MaxGroup, part of the Remax group, also mentioned that after the arrest, there was an increase in demand for luxury properties from foreign buyers, which ensured that demand spread throughout Portugal, despite the fact that Lisbon was the city of choice.

“To live or invest, Lisbon continues to be a very attractive city and increasingly attracts buyers from all over the world. These real estate clients are now positioned in the luxury segment and see Lisbon as a set of factors that drive them to make their purchase, ”he said.

Among the selection criteria for foreigners is the price, “as Lisbon continues to be one of the European capitals with reference values lower than in Europe.” But there are other factors as well, such as security, climate, tax breaks promoted by the protocols between Portugal and its countries of origin, as well as the history, light and typicality of the capital.

X-ray

It is true that major international fortunes have turned their gaze to the Portuguese real estate market, more specifically to luxury homes. The conclusion is based on the research of an idealist who analyzes the international origins of research on properties for sale in Portugal worth over € 1 million. However, he admits that there are some countries that show a particular interest in luxury real estate in our country: the Spaniards (11.7%) conduct the most searches of this type, followed by the British (11.6%), North Americans. (9.7%), French (9.5%) and Germans (8.9%).

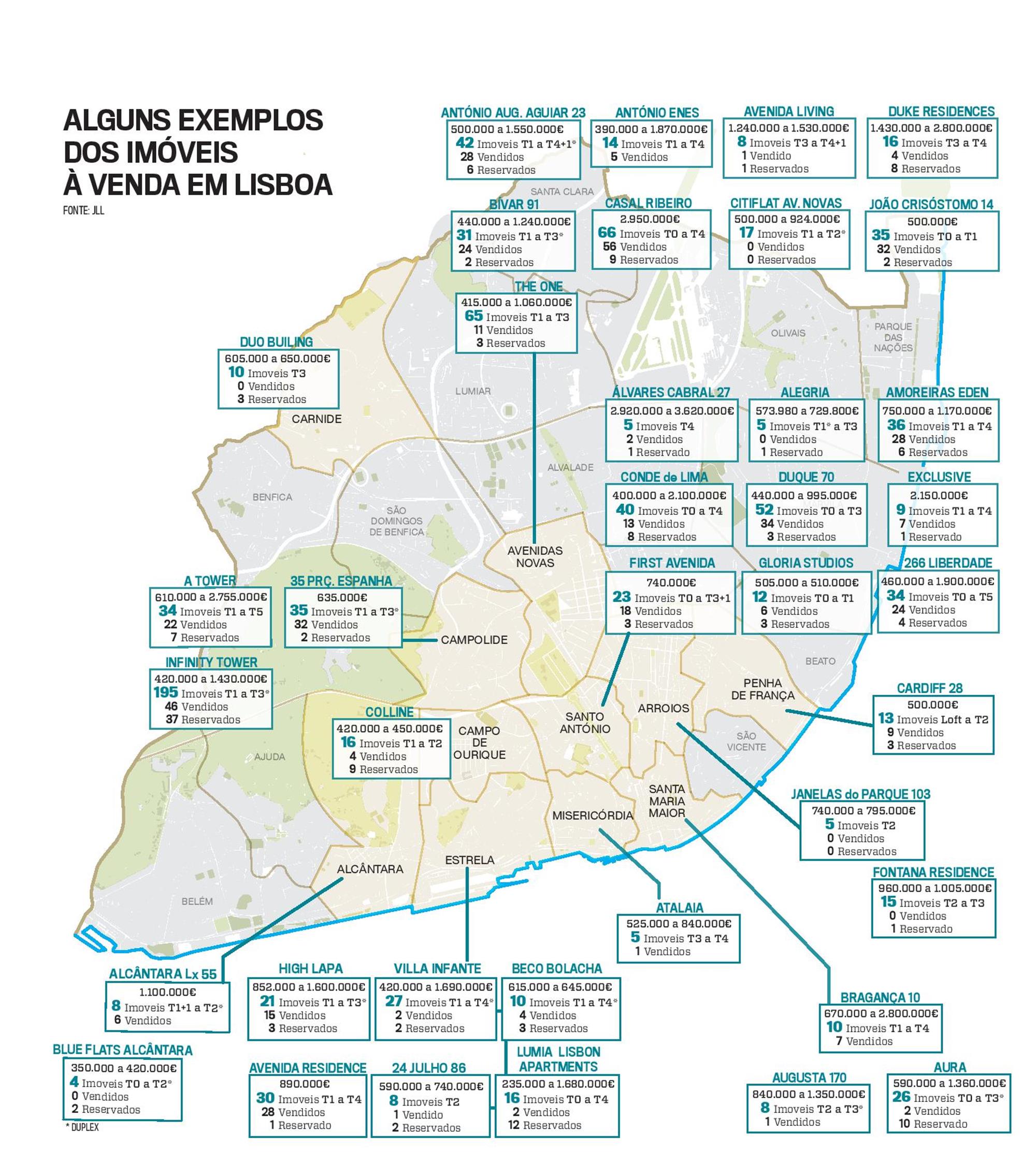

This international interest in luxury real estate in Portugal is mainly concentrated in six districts, accounting for 88.8% of visitors looking for luxury real estate for sale in the country. Disaggregated data shows that Lisbon is a preferred area for foreign investors, as this area is home to 40% of international searches for luxury real estate. The main interests of this luxury item are Spaniards (13%), North Americans (11.1%), British (10.8%), Brazilians (10.4%) and French (7.1%).

Of the six areas of greatest interest to high-end buyers, Faro is in the ranking, with 28% of the luxury goods polls conducted by foreigners. The nationalities most looking for luxury homes in the Algarve are English (12.9%), Dutch (11.5%), French (10.5%), Germans and Spanish (10% each).

The third place in the ranking is occupied by Setubal with 8% of searches. Countries that showed more interest in this district are Germany (15.1%), Spain (14.1%), UK (11.7%), France (10.5%) and the USA (7.6%) …

The Porto area ranks fourth with 6% of luxury polls conducted by foreigners. The Spaniards showed the greatest interest with 13.6% of visits. This is followed by Brazilians (12.5%), French (11.9%), North Americans (11.2%) and British (7.5%).

The fifth place is occupied by the island of Madeira, which accounts for 4% of searches for luxury goods carried out in Portugal by foreigners. The most active in searches are the British (21.1%) and Germans (20.9%), followed by North Americans (5.4%), Swiss (4.6%) and French with 4.3% of searches.

Finally, in sixth place in the ranking is the Braga district with 2% of the polls. The greatest interest in the area was shown by the French (25.7%), followed by the Brazilians (12%), the Swiss (10.5%), the Spaniards (10.0%) and the British (8.3%).

Click on the image below for more details.

Oscar Roche infographics

“Internet specialist. Evil entrepreneur. Troublemaker. Analyst. Tv aficionado. Thinker. Passionate explorer. Bacon guru.”

Economy

What factors impact financial markets?

The global financial markets are now hugely complex, with traders and analysts around the world looking closely for signs of movement. What are some of the most important factors to be aware of that impact the financial markets?

Geopolitical events

With news breaking from different countries throughout the day, many different stories could affect the markets on any given day. For instance, economic indicators such as the European Central Bank’s inflation rates and gross domestic product numbers released by each country can determine which direction the markets take. Stocks, currencies and other financial instruments can all vary depending on these areas.

Major events such as war breaking out, natural disasters and elections also have an effect. When we look at the commodities market, climate change is an issue to bear in mind, with unusual weather sometimes causing scarcity or abundance of a certain product.

An interesting aspect of the modern financial world is the way that the different markets are linked. This means that any important event or news story that affects one area could easily affect another, even if the link isn’t obvious at first sight. We can also see how local shocks and events can quickly have an effect at a global level.

The financial crisis of 2008 is a good example, as it started with a serious downturn in the US housing market. Although this appeared to be a localized issue at first, it soon revealed some major issues with the global banking setup that caused problems around the planet affecting millions of people and diverse industries.

Speculation and investment trends

The previous factors all point toward the markets changing, and there’s no shortage of traders around the world waiting to see what happens next and how they can benefit. This means that we need to take into account other issues such as speculation and investment trends in the markets.

Armed with a variety of tools, including candlestick charts, traders try to identify trends such as support and resistance levels. They use the information they glean from the charts to make their moves, which can influence the general market if enough people make the same moves or if the amounts involved are significant.

Once an investment trend begins, it can have a knock-on effect that would have been impossible to predict at the outset. The example of Bitcoin and other cryptocurrencies shows how something that starts small can grow impressively. Cryptocurrencies have now gained enough mainstream appeal to influence and disrupt many industries, from healthcare to gaming and banking.

It’s important to understand how the leaders of a company operate and how they have faced challenges in the past. If we look at banking and the Bank of New York Mellon in particular, we can see that its history can be traced back to 1784, so it has overcome all the major events that have occurred since then. With some of the biggest names in the business world making up its key institutional investors, this is a company that we would expect to react effectively to changing markets.

Regulatory changes and company results

Just about every industry represented in the financial markets has laws and regulations that govern it. This means that the fear of harsher new laws is an almost constant threat. Meanwhile, the hope that beneficial changes to the regulations help businesses prosper is the other side of this matter that investors keep a close eye on.

Let’s not forget the role played by the profit and loss results produced by major companies. It’s clear that these results have an almost immediate effect on their stock prices. However, we should also bear in mind that this effect can reach other areas of the economy. A surprising set of results for a large business can produce shock waves that travel around the market.

What impact do they cause?

From the wide variety of examples that we’ve looked at here, it’s clear that the impact isn’t going to be the same in every case. While one set of circumstances might snowball and cause a huge impact, another might cause a limited impact before the news disappears as other events overtake it.

Having said that, one of the key issues that they cause is a higher degree of market volatility. We can see how this works by looking at an area such as the COVID-19 pandemic in 2020. The markets became a lot more volatile as the different aspects of the pandemic became clear. Streaming companies, healthcare companies and video conferencing technology firms made huge profits, while airlines and hotels were among those to lose out massively.

Working out the overall impact of a particular situation is almost impossible to do now. With so many traders looking over the latest news stories and numbers with advanced tools, the original impact can quickly grow or simply disappear. Therefore, the key for investors is to understand emerging trends and react to them before it’s too late.

These details reveal how complex the global financial market is now. It’s a fascinating world, and with more information at our fingertips than ever before, it’s something that anyone can start to research and understand in their own way.

Proud web evangelist. Travel ninja. Creator. Freelance food nerd. Passionate bacon fanatic.

Economy

Everything has been delivered. 10 Bugatti Centodieci are already in the hands of the owners

OAll Bugatti Centodieci have been delivered, the Molsheim-based brand said on Monday. Cristiano Ronaldo received the number 07 in October this year. and Bugatti has now revealed that the latest unit – #10 – is already in the possession of its owner.

“The Centodieci combines all the values of the Bugatti brand in an extraordinary package: rarity, innovation, heritage, craftsmanship and unrivaled performance. The production batch of 10 units was so in demand by our customers that it was sold before the Centodieci. was even officially presented,” said Christophe Piochon, president of Bugatti.

This latest example is finished in Quartz White with carbon fiber trim on the bottom and matte grilles. The brake calipers are painted in Light Blue Sport, as is the logo on the rear that refers to the EB110, the iconic Bugatti model that inspired this Centodieci. Inside, the predominant color is also blue, as you can see in the images above.

This block is powered by the same block as the other nine instances. The 8.0-liter W16 with four turbines is capable of developing 1600 hp. In terms of performance, this allows the Centodieci to hit 100 km/h in just 2.4 seconds and reach a top speed of 380 km/h.

Recall that each unit costs the owners eight million euros before taxes.

Read also: We already know when the Bugatti Centodieci fell into the hands of Ronaldo.

Always be the first to know.

Sixth year in a row Consumer Choice and Five Star Online Press Award.

Download our free app.

“Internet specialist. Evil entrepreneur. Troublemaker. Analyst. Tv aficionado. Thinker. Passionate explorer. Bacon guru.”

Economy

The first Dacia hybrid. “The cheapest hybrid family on the market”

BUT Dacia revealed this Monday that the hybrid engine has been available since March on the Jogger, the Romanian brand’s model known to be available with a seven-seat variant.

The Jogger Hybrid 140, Dacia’s first hybrid, will hit dealerships in March, but customers can expect and order it as early as January.

The price has been revealed by Dacia and since it’s only available in the seven-seater SL Extreme, it starts at €28,800. The brand claims it is “the most affordable hybrid family car on the market.”

Available in six existing colors to celebrate the launch of this hybrid, there will be a slate gray version, as you can see in the images above.

Equipped with a 1.6 liter four-cylinder petrol engine with 90 hp, the Jogger is also powered by two electric motors (a 50 hp engine and a high-voltage starter-generator). The total power is 140 horsepower. The electric transmission is automatic, four-speed, connected to an internal combustion engine, and two speeds are connected to an electric motor. This combined technology was possible, according to Dacia, only due to the lack of clutch.

Combined with the energy recovery levels of the 1.2kWh (230V) battery pack and the efficiency of the automatic transmission, regenerative braking delivers all-electric traction on 80% of urban journeys and saves up to 40% of fuel compared to a combustion engine vehicle.

Read also: Dual-fuel Dacia Jogger Eco-G. We tried 5 seater and LPG…

Always be the first to know.

Sixth year in a row Consumer Choice and Five Star Online Press Award.

Download our free app.

“Internet specialist. Evil entrepreneur. Troublemaker. Analyst. Tv aficionado. Thinker. Passionate explorer. Bacon guru.”

-

World4 years ago

The Gabby Petito case. Brian Landry set up camp with his family after his girlfriend disappeared

-

Top News6 years ago

Tristan Thompson reacts to Khloé Kardashian’s new appearance

-

Economy3 years ago

Everything has been delivered. 10 Bugatti Centodieci are already in the hands of the owners

-

Top News6 years ago

TLC ‘sMothered’ recap: ‘Party curled up,’ boyfriend problem

-

Top News6 years ago

Alex Cooper hosts a solo podcast

-

Top News6 years ago

2021 Ford Bronco price: Here’s how much the 2-door and 4-door cost

-

Tech5 years ago

Fall Guys is supplying out a legendary costume and Kudos as an apology present

-

Top News6 years ago

Chiara de Blasio was ‘very cold’ during the arrest of the protest: witness